Commodity Morning Insights 15th October 2025 by Axis Securities Ltd

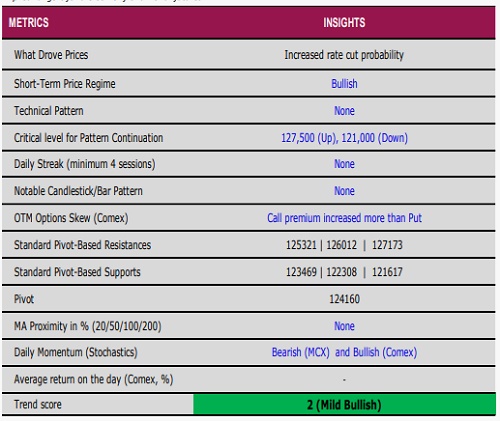

Comex Gold extended its rally, gaining nearly 1% in the previous session as expectations of a rate cut strengthened following comments from Fed Chair Jerome Powell, who noted that downside risks to employment appear to have increased. His remarks boosted the appeal of precious metals, driving gold prices to a new record high of $4,180 as investors sought safety and ramped up bets on further U.S. monetary easing

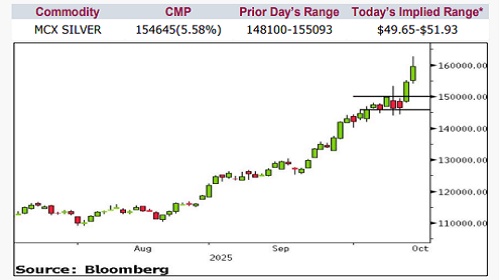

Comex Silver retreated from its all-time high of $53.7, ending lower by over 1.5% as profit booking emerged after a four-day winning streak. However, the near-term trend remains positive as long as prices hold above the $49 support level

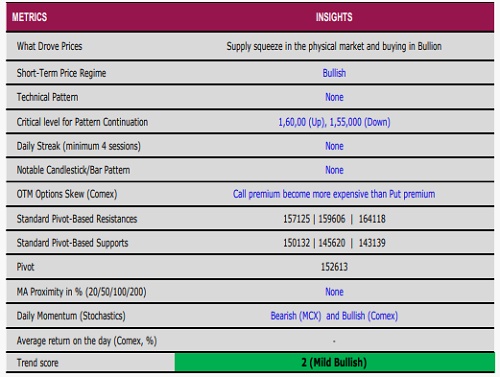

Nymex Crude Oil declined more than 1.5% in the previous session, weighed down by renewed trade concerns and oversupply worries. Prices fell for the third time in four sessions as U.S.–China trade tensions resurfaced and the IEA raised its crude surplus estimates for this year and the next. The agency now expects supply in 2026 to exceed demand by nearly 4 Mn barrels per day

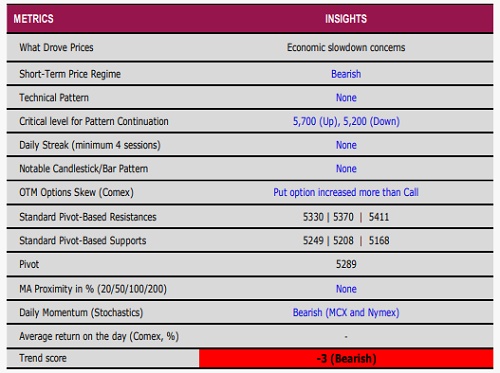

Comex Copper slipped over 2% as a stronger dollar triggered profit booking in the counter. However, the broader trend remains constructive, supported by tight supply and steady demand across the base metals complex. Chile’s Codelco has warned that its El Teniente mine will operate below capacity for the next several months, potentially tightening global copper supply

Gold

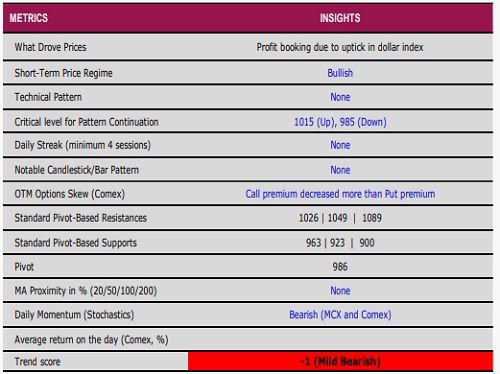

Silver

CRUDE OIL

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633