MCX Silver July is expected to move in the band of Rs105,500 and Rs107,500 - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to face hurdle near $3380 and move lower towards $3310 amid easing Middle east tension. Growing bets of ceasefire agreement between Israel and Iran would dampen the safe haven buying. US president Donald Trumps announced that both nations had agreed to a complete ceasefire, adding that Iran will begin the truce immediately, followed by Israel after 12 hours. Meanwhile, dovish comments from few Fed members would limit the downside in the yellow metal. Meanwhile, investors will eye on the testimony of US Fed chair Jerome Powell which would give further clarity on future path of interest rate.

• Spot gold is expected to move towards $3310, as long as its stays below $3380. Only a move below $3310 it would turn weaker towards $3290. MCX Gold Aug is expected to slide towards ?98,400, as long as it trades under Rs 99,800.

• MCX Silver July is expected to move in the band of Rs105,500 and Rs107,500

Base Metal Outlook

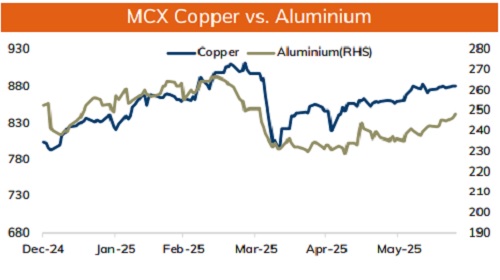

• Copper prices are likely to hold support and move higher amid softer dollar and improved risk sentiments. Easing geopolitical tension in the Middle East would improve risk sentiments and support prices. Additionally, depleting inventory levels and supply concerns would provide support to prices. Widening LME copper backwardation clearly indicates tightness in the market. Now, investors will also keep an eye on Fed Chair Jerome Powel’s testimony to get more clarity on timing of next rate cut.

• MCX Copper July is expected to move higher towards Rs 895, as long as it trades above Rs 882 level. Only above Rs 895 it would open the doors towards Rs 902.

• MCX Aluminum July is expected to find support near Rs 249 and move higher towards Rs 254 level. MCX Zinc July is likely to move higher towards Rs 258 level as long as it holds above Rs 252.

Energy Outlook

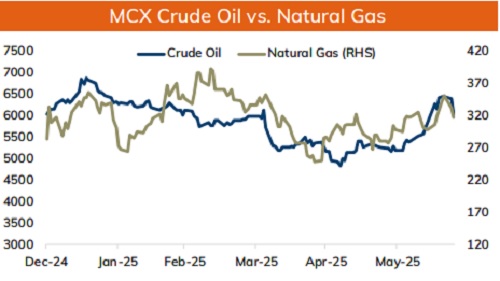

• Crude oil is likely to remain volatile and trade with weaker bias amid easing geopolitical tenson in the Middle East. Potential ceasefire agreement between Israel and Iran would ease supply concerns. Further, de-escalation between the two nations would improve oil supply through the Strait of Hormuz. Meanwhile, traders will keep an eye on key economic numbers from U.S, Fed chair Powell speech and developments from Middle east to get more clarity.

• On the data front, A strong call base near $70 strike would act as key hurdle. On the downside $65 would act as immediate support. MCX Crude oil July is likely to move lower towards Rs 5600 as long as it trades under Rs 6100 level.

• MCX Natural gas July is expected to move lower towards rs 320 as long as it trades under Rs 335 mark.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631