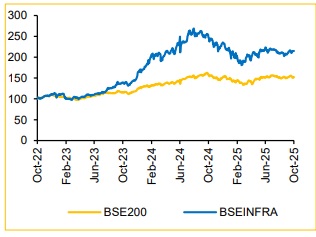

Cement Sector Update : Q2FY26E Result Preview by Choice Broking Ltd

Momentum Falters Amid Price and Volume Softness

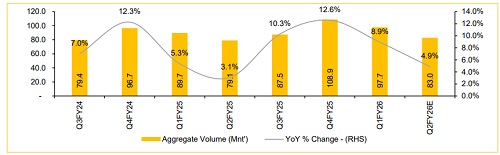

Seasonal weakness to weigh on volumes (ACEM, UTCEM to lead):

In Q2FY26E, we expect cement stocks under our coverage (11 companies) to report a 4.9% YoY volume growth, while volume may decline by 15.2% QoQ due to irregular monsoon and festive season. Overall, volume growth in Q2FY26E is expected to be weak. But, for the full year, it is anticipated to remain robust across major cement players, driven by improved demand visibility supported by GST rate cuts and stronger execution of cement companies' expansion plans. A key catalyst is the sharp rise in state government capex plans for FY26E—up 35% in West Bengal to INR 393Bn, +18% in Jharkhand to INR 226Bn, and +40% in northern states to INR 537Bn—which is boosting infrastructure activity and construction demand on the ground, particularly in the East and North regions.

Among the key players, ACEM is likely to outperform with a 5.1% YoY volume growth, driven by acquisitions. UTCEM, maintaining its leadership position, is expected to record a 5.0% YoY rise in volumes, supported by the scaling up of newly added capacities.

We factor in a price reduction of ~2.2% QoQ:

For Q2FY26E, cement demand remained weak across most regions in September 2025, impacted by rains and ongoing festive activities. Prices largely reflected GST-related adjustments, with companies passing on full benefits to customers. Western and Central markets remained stable, while Eastern markets remained weak due to adverse weather. In the South, demand showed a gradual recovery in some markets, while other areas continued to witness weak offtake. Northern markets improved modestly, but a meaningful pickup is expected in H2FY26E. The all-India average selling price declined by ~INR 25 MoM to ~INR 330/bag, with dealers across regions anticipating stronger demand only after the festival season.

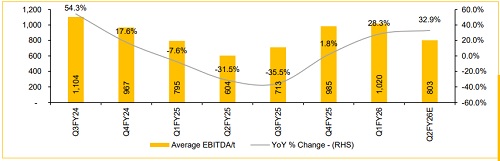

EBITDA/t expected to decline by 21.3% QoQ, owing to weak pricing, lower volume growth, offset by marginal cost headwinds and negative operating leverage:

In Q2FY26E, we expect average EBITDA/t for our coverage universe to reduce to INR 803/t, down from INR 1,020/t in Q1FY26. This decline is primarily impacted by a pan-India decline in cement prices, demand affected because of irregular monsoon and festive season, additional expenses of plant maintenance, and the freight expenses have increased on US Pet coke price owing to tariffs.

However, companies are focusing on lower cost with a reduction in power and fuel expenses, aided by a higher share of renewable energy and improved rail-road logistics mix across companies. This strategic shift is likely to sustain margin relief and enhance overall profitability, going forward.

Aggregate volume expected to grow by 4.9% YoY

Average EBITDA/t anticipated to grow by 32.9% YoY

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Diet Report : EU`s defence ramp-up - Advantage India by Elara Capital