Cement Sector Update: Prices steady with full GST benefits; pet coke rears its head By Emkay Global Financial Services

Prices steady with full GST benefits; pet coke rears its head

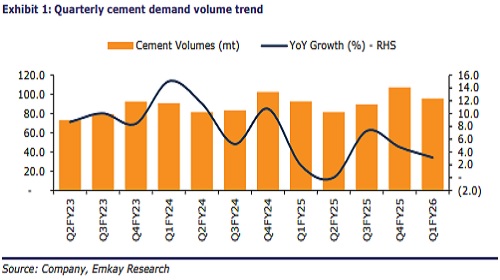

Our checks indicate that demand momentum is maintaining its slow pace as industry demand is expected to grow by a low single digit YoY in Q2FY26 as well (mainly due to more-than-normal monsoons). However, prices have largely held their ground, as average trade prices have dropped by a mere ~Rs5/bag on pan-India basis during the quarter. North and Central India stood as best performers with negligible price drop, while South and East India reported price reduction of Rs8/bag and Rs6/bag, respectively, on QoQ basis. Further, cement prices have dropped by Rs25-30/bag, reflecting full pass-on of the GST rate cut. On the cost front, except imported pet coke prices, other input fuel prices are broadly rangebound. We believe steady cement prices in a monsoon quarter, coupled with entry into a busy construction season with GST benefits, augurs well for the industry. We maintain our top-picks UTCEM, SRCM, and JKCE.

Key risks: Lower demand/prices, and higher cost escalations

Demand – Continuing its slow momentum

Checks suggest early single-digit YoY growth on pan-India basis in Q2FY26. Regionally, except North and Central India, each region reports flat (with positive bias) YoY volume growth. North and Central India should report a mid-single-digit growth rate, as key cement-consuming states of Rajasthan and Uttar Pradesh are expected to perform better due to lower rainfall YoY vs other regions/states. Post the GST rate cut, there has been no tangible pick-up in demand due to the festive period coupled with flooding in various parts of the country. Channel checks reveal offtake would improve from mid-Q3FY26.

Pan-India prices dip only by ~Rs5/bag in Q2; negligible in North India

Based on our pan-India checks and interaction with industry participants, average cement prices are down a mere Rs5/bag QoQ on pan-India basis in Q2FY26. This is the 2nd best performance by the industry in the past 5 years (1st being Q2FY24, wherein prices were flat QoQ, which was on a low base). During the quarter, on QoQ basis, prices dropped the most, by ~2% in South (Rs8/bag) and East India (Rs6/bag), and the least in North (down 0.5% or Rs2/bag) and Central India (down 1% or Rs4/bag). Prices in West India were down ~1.5% or Rs5/bag. Further, cement prices reflect the full pass-on of the GST rate cut and reduced selling prices by Rs25-30/bag in the trade and non-trade segments.

Barring imported pet-coke (spot at USD118/t), fuel prices largely in control

Sharp rise in ocean freight rates has escalated spot imported pet coke prices (CNF basis) despite range-bound Brent crude prices. Spot imported pet-coke prices are up ~9% vs Q2FY26 average levels to USD118/t (six-month high). We believe the aforementioned prices upholding or moving up will have a bearing on fuel costs of cement companies from Q3FY26 onward. Further, average Q2FY26 prices at USD113/t are up ~6% QoQ in Q2FY26. Meanwhile, spot imported coal prices are trading at ~USD100/t and have been rangebound in the past two quarters.

Key Charts

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Weekly Market Insights 25th August 2025 by Ashika Institutional Equities Research