Cement Sector Update : From pricing power to profit pressure by Prabhudas Lilladher Ltd

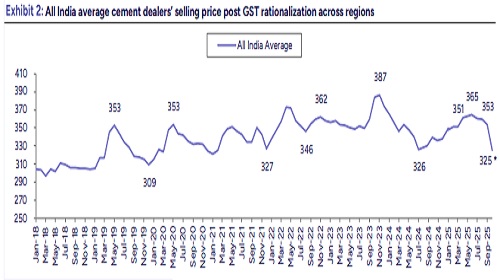

We expect our cement coverage universe to report Revenue/EBITDA/PAT growth of ~-15%/-26%/-36% QoQ (13%/55%/95% YoY) in Q2FY26, impacted by weak realizations and subdued demand during seasonally weak quarter. Cement prices were firm in July but weakened in August due to muted demand and heavy rainfall across India. They remained largely flattish in September (adjusting for GST revision) despite intense rainfall, labour shortages, and festive disruptions. Demand remained patchy across regions, affected by weak infrastructure activity, GST cut anticipation while rural/IHB segments offered partial support. Resultant, overall industry volume growth is anticipated at lower single digit. On the cost front, pet coke prices have inched up towards ~USD 120/t which can add pressure on margins in coming quarters.

During Q2FY26, southern and eastern markets witnessed the sharpest price corrections, weighing on profitability. Consequently, cement companies under our coverage are likely to post a sequential decline of Rs150-240/t in EBITDA, post strong Q1FY26. As execution of GST rationalisation is almost completed across regions, we believe companies would not be able to increase prices immediately and would have to wait for strong demand uptick. We expect prices to improve once post-festive recovery in demand is seen, aided by GST benefits and overall enthusiasm in economy aiding realty sector. Key monitorables to watch out for are: 1) demand recovery post-Diwali, pace of infrastructure activity & GoI spending, 2) improvement in prices amid-GST rationalisation, and 3) trend of pet coke and other RM costs heading into H2FY26. Top Picks: UTCEM & ACEM

Seasonal weakness in cement realization: Realizations for our cement coverage universe are expected to decline by ~2.2% QoQ (+4.9% YoY) in Q2FY26, impacted by weak demand during the monsoon season and the GST rationalisation. Pricing remained steady in July but softened in August due to rains and remained flattish in September, as per our channel checks. On an average, cement prices declined by ~2% QoQ, with the steepest correction of ~4% QoQ in the East, ~3% QoQ in the South and ~2% the West. The North and Central regions’ prices were flattish QoQ. Going forward, we expect realizations to remain steady in the near term, with recovery likely post-festive season in Q3FY26. GST rationalization could play as spoilsport and restrict companies from taking price hikes in the near future.

Weak volume growth amid monsoon disruptions: We expect our cement universe companies to witness ~9% YoY volume growth in Q2FY26, aided by inorganic acquisitions of the industry leaders. Despite the government’s continued push on infrastructure projects, overall cement demand remained subdued during the quarter, impacted by extended rainfall, labor shortages, GST cut anticipation and festive-related disruptions across regions. Rural and IHB demand provided only partial support but was insufficient to offset the slowdown. We expect our coverage universe volumes to grow ~9% YoY to ~76mt (-13% QoQ), while overall industry demand is expected to grow at 3-5% YoY in this quarter.

Profitability to moderate QoQ but strong improvement seen YoY: Power and fuel costs are expected to remain flattish in Q2FY26; however, the uptick in pet coke prices during the quarter is likely to start impacting margins in 2HFY26. Freight costs are likely to remain stable as companies continue working on optimizing lead distances, while other overheads were partly cushioned by cost-control measures. However, relatively better prices in seasonally weak quarter are expected benefit profitability on YoY basis. On sequential basis, average EBITDA/t for our coverage universe is expected to decline ~16% QoQ (by Rs179/t) to ~Rs920/t, though YoY growth of ~44% (+Rs280/t) is expected given the poor base and extremely low prices in East/South region in Q2FY25. Among our coverage, players with higher exposure to eastern and southern markets are likely to see the steepest sequential declines in profitability.

Change in rating/estimates:

Shree Cement: We upgrade the stock to Accumulate from Hold, mainly prompted by correction in stock price during the quarter and introduction of FY28 estimates. We roll forward to Sept’27 and assign it an ‘Accumulate’ rating with a revised target price of Rs32,410 (earlier Rs30,001). At CMP, the stock trades at an EV of 16.6x/14.3x FY27/28E EBITDA.

ACC: We cut our target multiple for ACC to 10x from 12x earlier, on delays in improvement in its cost structure and the absence of further capacity additions, which are primarily being undertaken by the parent company. We maintain BUY with a revised target price of Rs2,311 (earlier Rs2,543) on low valuations and as we roll forward to Sept’27. At CMP, the stock trades at an EV of 8.3x/7.3x FY27/FY28E EBITDA.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271