Buy UTI AMC Ltd for the Target Rs. 1,550 by Motilal Oswal Financial Services Ltd

Strong fund performance to revive market share

SIPs continue to scale up; least re-rated stock in the universe

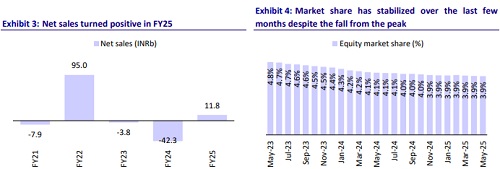

* UTI AMC’s fund performance over the past five months has improved considerably, with an average of ~70% equity AUM appearing in Q1 and Q2 on a one-year return basis in May’25 vs an average of 25% in the preceding 12 months. This, we believe, can drive equity market share gains, which have been stable at 3.9% over the past seven months.

* Recent product launches (Quant Fund launched in Q4FY25 and Multi-Cap Fund in Apr’25) are likely to support equity inflows. Ongoing traction in hybrid funds and the rollout of smart beta and thematic offerings further enhance UTI AMC’s positioning across investor segments.

* UTI AMC’s SIP AUM grew 22% YoY to INR375.9b, supported by increased investor engagement through MFDs and direct platforms. Despite weaker markets, SIP inflows in FY25 rose 23% YoY to INR83.3b. Notably, 47.9% of equity/hybrid gross sales were mobilized through digital platforms in Q4FY25, reflecting the success of platform integration and marketing automation.

* UTI AMC continues to deepen penetration in B30 cities, with 22% of monthly average AUM in Mar’25 originating from these regions—outperforming the industry average of ~18%. The company added 68 branches in Tier-2 and Tier-3 locations during FY25, driving incremental folio growth (0.9m net folio additions in FY25).

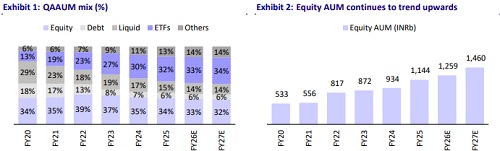

* Overall yields stood at ~34bp in Q4FY25. While equity and hybrid funds earned ~75bp, a growing share of passive flows (ETF/index funds at 5–6bp yield) is expected to lead to a slight yield contraction (1-2bp), partially cushioned by distributor commission rationalization.

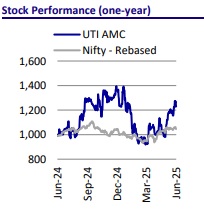

* We expect UTI AMC to report AUM/Revenue/Core PAT CAGR of 17%/13%/20% over FY25-27. Sustained strong performance has been a key re-rating driver for AMC stocks. UTI AMC’s discount to other players has widened over the past few months. We reiterate our BUY rating on UTI AMC with a one-year TP of INR1,550, based on 19x FY27E EPS (28x Core EPS).

Fund performance sees significant improvement based on one-year returns

* As a % of Monthly Average AUM (MAUM): The share of AUM ranked in the top quartile (one-year returns) rose sharply to 48% in May’25, up from just 12% in May’21. Conversely, the proportion of AUM in the top quartile based on three-year returns declined to 8% from 38% over the same period.

* Based on the number of schemes: The number of schemes ranked in the top quartile (one-year return) improved significantly to 6 in May’25 from 2 in May’21. For three-year returns, the number of top-quartile schemes rose modestly to 3 from 2 over the same period, indicating an overall positive trend in performance.

Equity segment: Better fund performance and new product launches being key growth drivers

* Equity QAAUM grew 7.2% YoY to INR908.6b, with net sales turning positive at INR13b in 4QFY25, compared to net outflows of INR13.4b in 4QFY24. However, on a yearly basis, net outflow stood at INR19.2b, reducing YoY from INR56.7b in FY24.

* The equity market share declined to 3.1% in 4QFY25 vs 3.7% in 4QFY24 and 3.2% in 3QFY25. However, with improving fund performance (57% of equity AUM in the top two quartiles over the past year), the launch of new funds (BAF launched in Jul’23, multi-cap in FY25, Quant Fund in 4QFY25) and the scaling up of SIPs through digital partnerships are expected to support growth in equity AUM, thus leading to higher market share for UTI AMC.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412