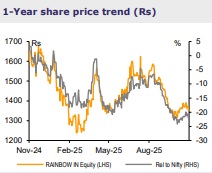

Buy Rainbow Children`s Medicare Ltd for the Target Rs.1,475 By Emkay Global Financial Services Ltd

Transient weakness; building blocks in place

Rainbow’s Q2FY26 revenue grew 7% YoY, missing the Street’s expectations/our estimate by 3%/4%, respectively, largely due to a lower incidence of vector-borne diseases, echoing the broader industry’s sentiment. Despite the soft quarter, we remain constructive on the outlook, supported by the management’s guidance of 20% revenue CAGR over the next 2-3 years, along with building a leadership team (Group CEO appointed) to focus on ramping up of ~750 beds added over the last 2Y. Additionally, improving profitability from new units, which are expected to achieve breakeven within 12–18 months, should help cushion the impact of Rainbow’s phased bed expansion plan over FY26–28E (~600 beds). We, thus, model flattish margins and 14%/15% revenue/EBITDA CAGR, respectively, over FY25–28E. Factoring in the Q2 miss, we cut FY26E revenue/EBITDA by 5%/6%, respectively, and trim our Sep-26E TP by 6% to Rs1,475, based on 25x Sep-27E pre-IndAS EV/EBITDA (10% cut in multiple, in line with sector’s multiple).

Muted trajectory exacerbated by absence of seasonal tailwinds

Rainbow reported topline growth of 7% YoY (Rs4.5bn), led by ARPOB growth of 15% YoY, though partially offset by a 9% decline in OBD. EBITDA remained flat YoY at Rs1.5bn, with margin decline of 176bps YoY on account of a muted revenue trajectory as well as contraction in the gross margin. At mature facilities, revenue declined 3% YoY, while OBD fell 19%; ARPOB rose 19% YoY, with occupancy at 56%. At new facilities, revenue grew 35% YoY and OBD/ARPOB rose 20%/8% YoY, respectively, mainly on the back of beds added (22% YoY). PAT came in at Rs753mn, down 5% YoY, with a decline in other income (-27% YoY) contributing to the muted operational metrics. The payor mix has been stable at 47%/53% for cash/insurance patients (flat YoY). Q2 capex was Rs2.6bn (inclusive of acquisitions). Net cash as of Sep-25 was Rs5.6bn.

Earnings call KTAs

1) The management has guided for consolidated revenue CAGR of 20% over the next 2-3 years, on the back of 780 beds added over the last 2 years and further bed additions planned for the next 3-4 years. 2) With the appointment of the new Group CEO, the management plans to streamline the next phase of growth and further strengthen business operations. 3) Tertiary and quaternary care contributed ~40% to H1FY26 revenue, while IVF is expected to grow 50% YoY (25% CAGR ahead) in FY26 to Rs400mn+. 4) International business MRR is ~Rs30mn – the management targets growing this to at least 10% of revenue in the next 5 years. 5) Project updates: Rajahmundry unit commenced operations in Q2, while Warangal and Guwahati (Rs85mn MRR) units were fully integrated. Rajahmundry unit is expected to breakeven in 15- 18 months, while Electronic City and Hennur (to operationalize in Q3/Q4) are expected to breakeven in 12-15 months. 6) For H2FY26, the company has planned capex of Rs1bn; Rs6bn over the next 3 years. 7) Ahead, the management expects mature units to grow 8-10% organically. 8) Despite pricing in tier 2/3 markets (Vizag, Vijayawada) being significantly lower (25-30%) vs those in tier 1 market, the margin profile remains the same, owing to strong brand equity developed in these markets.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354