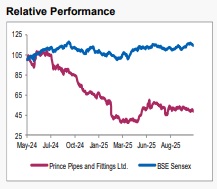

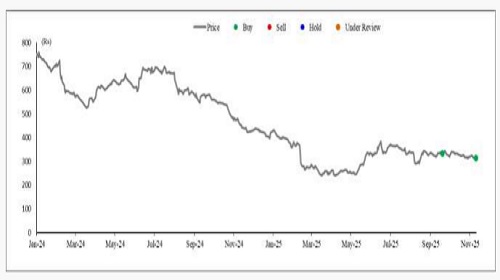

Buy Prince Pipes & Fittings Ltd For Target Rs. 400 - Axis Securities Ltd

Strengthening Brand & Retail Presence; Steady Recovery Ahead

Est. Vs. Actual for Q2FY26: Revenue - MISS; EBITDA (Adj.) - BEAT; PAT - INLINE

Changes in Estimates Post Q2FY26 Result

FY26E/FY27E: Revenue: 0%/0%; EBITDA (Adj.): 0%/0%; PAT : 0%/0%

Recommendation Rationale

* Foucs on High Margin and Value-Add products: The company’s EBITDA margins stood higher than expected at 9.3%, supported by a favourable product mix and strong growth in value-added segments, particularly fittings, CPVC, and bathware. Management emphasised a strategic focus on increasing the share of higher-margin plumbing, CPVC, and fittings segments within the overall mix while maintaining a stable presence in the agri segment. Stable PVC resin prices and improved operating leverage from higher utilisation rates are expected to further aid margin recovery in H2FY26. Continued investments in brand building, SKUs, and dealer expansion in the bathware segment are likely to enhance profitability consistency and reduce dependence on volatile raw material cycles.

* Long-Term Structural Drivers Intact: The government’s sustained infra push through housing and irrigation programs is driving steady underlying demand for piping systems. Additionally, the potential imposition of Anti-Dumping Duty (ADD) on imported CPVC resin could serve as a margin stabiliser for players like Prince Pipes. Management also indicated expectations of volume and margin recovery in H2FY26, supported by demand normalisation post-monsoon, stable PVC prices, and improving utilisation levels.

* Diversification – Aquel brand: The Aquel bathware division continues to gain traction with new showroom additions across key urban and semi-urban markets such as Uttar Pradesh and Rajasthan. Management indicated that Aquel strategically complements the core pipes and fittings portfolio, enabling cross-selling opportunities and enhancing brand visibility. While the segment remains in its investment phase with limited revenue contribution at present, it is expected to scale meaningfully over the next 12–18 months (FY27 onwards). Over time, Aquel is positioned to become a key value-accretive, highermargin business driving portfolio diversification for Prince Pipes.

Sector Outlook: Positive

Company Outlook & Guidance: Management maintained a positive outlook for H2FY26, supported by stable PVC prices, improving demand momentum post-monsoon, and easing channel inventory. The company expects volume recovery and margin improvement driven by higher utilisation, cost rationalisation, and a superior product mix. The focus remains on expanding retail reach, the Aquel bathware brand, and the value-added portfolio to enhance profitability consistency. Over the medium term, management guided for steady double-digit volume growth, sustained margin recovery, and healthy cash generation. It plans to maintain a disciplined capex approach and indicated margin improvement sequentially, likely in the 11–13% normalised range.

Current Valuation: 23X FY28E EPS (Earlier 25X FY27E EPS)

Current TP: Rs 400/share (Earlier TP: Rs 400/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

Prince reported revenue of Rs 595 Cr, down 4.4% YoY, missing estimates. The overall industry demand saw a slow recovery amid volatile polymer prices. Gross margins expanded by 127 bps YoY. Reported EBITDA stood at Rs 52 Cr, up 20.6% YoY, with an EBITDA margin of 9.3%, a 192 bps YoY improvement. The company reported PAT of Rs 15 Cr, flat YoY. During the quarter, volumes remained flat YoY at 42,761 MT, reflecting a higher contribution from value-added products.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633