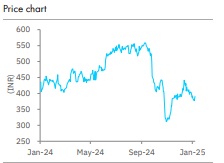

Reduce Indraprastha Gas Ltd For Target Rs. 383 By Elara Capital Ltd

Recovering from APM rejig shock

Indraprastha Gas (IGL IN) has corrected 29% in the past six months and significantly underperformed Nifty Mid-Cap Index (down 11%) due to overnight reduction in APM gas supply, though partly restored in January 2025. For the next few quarters, we expect IGL’s earnings to grow +10% YoY due to base effect of delay in CNG price hike amid rising gas cost in FY25. But we foresee margin pressure on earnings to remerge later on due to continuously falling APM gas supply. We raise TP to INR 383 from INR 274 due to normalization of EBITDA/scm margin and revise IGL rating to Reduce from Accumulate.

APM de-allocation dents margins:

IGL’s Q3FY25 PAT stood at INR 2.9bn (Elara: INR 3.2bn), down 27% YoY, on account of a 40% drop in EBITDA/scm margin (down 33% QoQ). This was owing to a sudden drop in cheaper domestic administered-pricemechanism (APM) gas availability, which was partly offset by volume growth of 7% YoY. Similarly, on QoQ basis, PAT fell 34%.

High gas procurement costs hit margin and volume growth:

EBITDA/scm margin fell 40%/33% YoY/QoQ to an 18-quarter low of INR 4.3/scm, due to 1.88mmscmd reduction in APM gas supply in Q3FY25 that led to APM gas share for CNG falling from ~67% in Q2FY25 to 40% in the second half of Q3FY25. IGL could not pass-on the hike in gas cost immediately. However, APM supply was partly restored to 50% of CNG demand in January 2025, providing some relief to CGD companies. Given high international LNG prices in Q3, IGL rationed limited gas availability, which partially hit CNG sales volume.

Volume guidance retained, additional gas volume procured through new LNG contracts:

Gas volume growth was weak at 7% YoY to 9.1mmscmd (Elara: 9.2mmscmd), versus 11-17% YoY pre-Covid (Q1FY17-Q3FY20) due to weak CNG volume growth (6% YoY) in Delhi. This was owing to declining CNG-based DTC bus fleet. Although industrial PNG and domestic volume rose 14% and 17% YoY respectively, CNG comprised 75% of total volume. IGL reiterated 9.5mmscmd FY25 exit rate guidance and expects 10.5mmscmd exit rate in FY26. EBITDA/scm margin guidance was at INR 7-8. Reduction in APM gas allocation would warrant a price hike of INR 2/scm to reach guided margin, as APM shortfall is compensated through costlier new LNG contracts

Revise to Reduce from Sell; TP raised to INR 383 from INR 274:

We increase FY26E/27E EPS estimates by 25%/35%, led by higher EBITDA/scm margin at INR 7.0 (from INR 5.7), partly due to restoration of APM gas supply. Consequently, we raise TP to INR 383 from INR 274 and revise IGL to Reduce from Sell. However, we estimate APM gas allocation to continuously drop to ~25% in the next 2-3 years due to an 8% YoY decline rate in gas production for ONGC from older fields and +15% CNG volume growth across India. So, margin pressure on IGL’s CNG segment would emerge. Our DCF-based long-term EBITDA/scm margin is INR 7.0 (from INR 5.7) from FY26E, with volume CAGR of 8.3% in FY24-29E (from 7.1%) and WACC at 11.6% (from 10.0%).

Please refer disclaimer at Report

SEBI Registration number is INH000000933