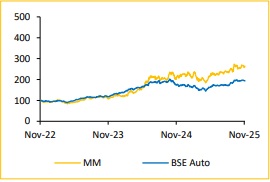

Buy Mahindra & Mahindra Ltd For Target Rs. 4,450 By Choice Broking Ltd

Strong Demand Sustains Growth Momentum

Market Share Leadership Sustained: M&M delivered a robust financial performance this quarter, reflecting continued execution of its focused strategy in core Automotive and Farm businesses. Standalone revenue rose 21% YoY, led by strong traction in both segments, Automotive up 18% YoY and Farm up 31% YoY.

The Automotive segment remained the key growth engine, supported by the company’s ongoing Utility Vehicle (UV) premiumisation strategy. While the Auto segment volume grew 13% and SUV volume increased 7% YoY, the corresponding revenue growth outpaced volume expansion, underscoring a purposeful portfolio shift towards higher-value models and improved realisation per vehicle.

Margin Accretion Driven by Premium Utility Vehicle Portfolio: The Auto standalone PBIT margin (ex-eSUV) expanded to 10.3% in Q2FY26, up from 9.5% in Q2FY25, benefiting from an improved product mix and premium SUV contribution. The electric SUV (e-SUV) portfolio also gained sequential momentum, with penetration rising to 8.7%, an increase of 90 bps QoQ, highlighting early success in M&M’s electrification roadmap in the premium segment.

View and Valuation: We believe the quarter's results demonstrate that M&M’s revenue outperformance is strategically driven by segment mix and pricing power, rather than mere volume expansion. This allows the company to successfully convert its strong topline growth into margin expansion. We have increased our FY26/27E EPS estimate by ~2.0/2.0%, factoring in strong growth in Q2FY26. Hence, we maintain our target price at INR 4,450, valuing the company at 25x (unchanged) the average of FY27/28E EPS, along with subsidiary valuation. We reiterate our ‘BUY’ rating on the stock, supported by M&M’s strategic focus on premium product portfolio expansion and anticipated recovery in rural demand.

Missed Revenue, while EBITDA margin beat:

* Standalone revenue for Q2FY26 up 21.3% YoY and up 2.7% QoQ to INR 3,50,798Mn (vs CIE est. at INR 3,67,455Mn). This was driven by 18.7% YoY growth in volume, along with an increase in Automotive ASP by 4.0% YoY, partly offset by flat growth in Farm segment ASP.

* EBITDA was up 22.7% YoY and up 34.9% QoQ to INR 64,674Mn (vs CIE est. at INR 53,648Mn). EBITDA margin was up 21bps YoY and up 439bps QoQ to 18.4% (vs CIE est. at 14.6%).

* PAT was up 17.7% YoY and up 31.0% QoQ to INR 45,205Mn (vs CIE est. at INR 35,496Mn).

.

.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131