Buy LG Electronics India Ltd for the Target Rs. 1,780 By Prabhudas Liladhar Capital Ltd

Positioned for sustainable growth

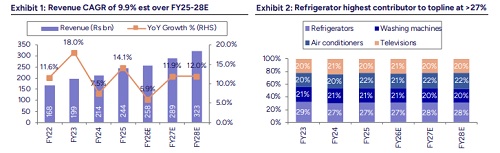

We initiate coverage on LG Electronics India Ltd (LGEL IN) with ‘BUY’ rating and TP of Rs1,780 valuing at 42x FY28E earnings. LGEL is a key player in the consumer electronics and home appliances market, offering a diverse product portfolio with a strong focus on innovation and quality. Extensive distribution network and premium brand positioning ensure its market leadership across categories. We believe LGEL is well-positioned to capitalize on the growth opportunities in home appliances and consumer electronics given its 1) market leadership across products, 2) strong manufacturing capabilities, 3) diverse product portfolio, and 4) strong brand loyalty. Further, LGEL has leading market share in the premium category of Washing Machine (36.9%), Refrigerator (43.2%), RAC (27.2%) and TV (62.9%). It has a track record of launching multiple industry firsts – an outcome of its consistent focus and industry leading R&D spends. We estimate revenue/EBITDA/PAT CAGR of 9.9%/10.9%/9.3% over FY25-28E led by 1) healthy revenue growth across segments, 2) capacity expansion plans, 3) expansion of AMC & B2B businesses, and 4) focus on local RM sourcing. Initiate ‘BUY’.

* Unlocking opportunities in Home Appliances segment: TAM for Indian appliances & electronics, excl. mobile phones, is expected to clock 13.8% CAGR to reach Rs6,190bn by CY29E from Rs3,245bn in CY24. LG's growth prospects remain strong, driven by rising consumer demand for premium products. Home Appliances and Air Sol segment (75.0% revenue share) grew by 13.7% CAGR over FY22-25, while RAC grew at 22.6% CAGR, led by strong demand for energy-efficient, AI-enabled ACs, and increasing penetration.

* Leveraging global R&D for localized innovation: LGEL’s strong manufacturing base in Noida & Pune, with a planned Rs50bn capex in a new facility in Sri City, Andhra Pradesh, enhances capacity and cost efficiency. Inhouse production of key components & automation-driven productivity gains strengthen control over quality & costs. With domestic sourcing rising to 54.1% in Q1FY26, long-standing supplier relationships, localization efforts to supply reliability and pricing competitiveness, consistent R&D (~0.4% of revenue) and access to LG Group’s global innovations, the company continues to launch several industry-first products, reinforcing its leadership in India’s premium consumer durables market.

* Diversifying business to create new growth opportunities: LGEL is leveraging LG Group’s technology to diversify beyond its core segments, targeting high-value industries and new sectors like hospitality. Rising B2B demand driven by growth in healthcare and infrastructure is prompting expansion into HVAC, commercial displays and LED panels. With strong leadership in premium categories of Washing Machine, Refrigerator, RAC and TV, premium category TAM expected to grow at 21.6% CAGR (CY24–29). LGEL is well-placed to sustain growth through premiumization and diversification. Also, the company’s AMC business is expected to grow at 30% CAGR to reach USD80–100mn over the next 3–4 years. Additionally, export opportunities are expected to expand to serve demand beyond India, expected to rise to 9–10% of revenue from 6% in FY25.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271