Buy JK Lakshmi Cement Ltd For the Target Rs. 930 By the Axis Securites

Recommendation Rationale

Capacity expansion to support volume growth: The establishment of a 1.35 mtpa grinding unit in Surat, with a capital expenditure of Rs 220 Cr funded through a mix of internal accruals and debt, is progressing well and is expected to be operational by Q4FY25. Additionally, the company plans a capacity expansion of 4.6 mtpa for cement grinding and 2.3 mtpa for clinker at a total capital cost of Rs 2,500 Cr (USD 65/tonne), to be commissioned in phases over FY26-27. These expansions will enhance market share and drive volume and revenue growth. We project a volume and revenue growth CAGR of 9%/11% over FY25-27E.

Levers in place to improve EBITDA/tonne: The company plans to drive performance through key initiatives, including optimising its geo-mix, increasing the production and sales of blended cement, raising the proportion of trade sales, and expanding premium and value-added products. Additionally, it aims to enhance logistics efficiency and increase renewable power and AFR use. The company expects cost savings of Rs 75- 100 per tonne. We project EBITDA/tonne growth at a 7% CAGR over FY24-27E, reaching Rs 1,080/tonne, supported by better realisations, higher volumes, and costsaving measures.

Robust cement demand in the country: Cement demand in the country is expected to remain strong, driven by increased capital spending by the central government on infrastructure projects, including roads, railways, and housing, along with robust real estate demand. Continued investment in infrastructure development is likely to support cement consumption further. The industry is projected to grow at a 7-8% CAGR over FY24-27E.

Sector Outlook: Positive

Company Outlook & Guidance: Given the government's emphasis on infrastructure development and increased budgetary allocation for housing and road projects, the outlook for the cement sector remains positive for the upcoming year. Management has guided for a 7-8% volume growth on a consolidated basis. Current prices are more potent than in Q3FY25, and higher demand is expected to support pricing.

Current Valuation: 9.5xFY27E EV/EBITDA (Earlier Valuation: 9.5x FY26 EV/EBITDA)

Current TP: Rs 930/share (Earlier TP: Rs 900/share)

Recommendation: We maintain our BUY recommendation on the stock and roll over our estimates to FY27.

Alternative BUY Ideas from our Sector Coverage UltraTech Cement Ltd (TP – 13,510/share), JK Cement (TP-5,380/share), Dalmia Bharat (TP-2000/share), Ambuja Cements Ltd (655/share), Birla Corporation(TP1340/share), Shree Cement (30,000/share), ACC Ltd (2,380/share), Star Cement (Rs 235/share)

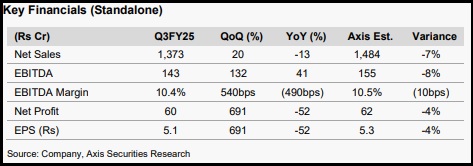

Financial Performance JKLC reported a weak set of results for the period, with volume, revenue, EBITDA, and PAT declining by 5%, 13%, 41%, and 52%, respectively, driven by lower realisations and negative operating leverage, falling below expectations. EBITDA margins fell to 10.4%, down from 15.3% YoY but in line with our estimate. The company posted a profit of Rs 60 Cr, representing a 52% YoY decline but a 691% QoQ increase, supported by lower costs. In the quarter, JKLC's volume stood at 2.25 mntpa, reflecting a 5% YoY decline. The company's EBITDA per tonne was Rs 634, down 38% YoY. Blended realisation per tonne stood at Rs 6,107, down 9% YoY and flattish QoQ. Additionally, the cost per tonne decreased by 5%/4% YoY/QoQ to Rs 5,475.

Outlook Given JKLC’s strong presence in North, West, and East India, along with strategic initiatives such as increasing sales of premium and value-added products, higher blending ratios, enhanced trade sales, greater use of green energy, and direct dispatches, the company is well-positioned to strengthen its topline and margins. We project a CAGR of 9% in volume, 11% in revenue, 34% in EBITDA, and 30% in PAT over FY25-27E. Monitoring cement pricing will remain crucial.

Valuation & Recommendation The stock is currently trading at 10.5x/9x EV/EBITDA of FY26E/FY27E. We maintain our BUY rating on the stock and roll over our estimate to FY27 with a TP of Rs 930/share, implying an upside potential of 10% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633