Buy JK Cements Limited For Target Rs. 1,500 By Axis Securities Ltd

Est. Vs. Actual for Q4FY25: Revenue – INLINE; EBITDA – INLINE; PAT – MISS

Changes in Estimates post Q4FY25

FY26E/FY27E: Revenue: 0.5%/4.2%; EBITDA: 2.9%/6.6%; PAT: 1.7%/3.9%

Recommendation Rationale

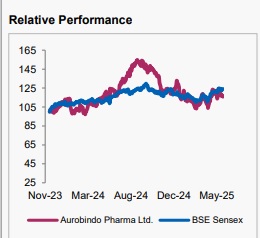

Steady Growth Backed by Robust US and Europe Sales: Auro’s revenue for Q4FY25 was reported at Rs 8,382 Cr, in line with our estimates. Revenue grew by 10.6% YoY and 5.1% QoQ, driven by strong performance in the US and European markets.

Margins Show Mixed Trends; Reported Profit Misses Estimates: Gross margins improved by 30 bps QoQ but declined by 50 bps YoY. EBITDA margins decreased by 70 bps YoY but improved by 128 bps QoQ. Reported profit stood at Rs 903 Cr, missing our estimate of Rs 1,026 Cr.

Sector Outlook: Positive

Company Outlook & Guidance: Aurobindo Pharma’s management remains optimistic about sustaining its growth trajectory in FY26, building on the strong performance of FY25. The company targets a high single-digit revenue growth for FY26, excluding transient products, with expectations of continued momentum in key markets such as Europe and North America. Management also aims to maintain EBITDA margins at current levels of ~21%, supported by a favourable product mix, stable raw material prices, and improved operating efficiencies. Over the past two years, Aurobindo has allocated Rs 7,000 Cr in Capex, focusing on areas such as Biosimilars and Pen-G (API). Its future valuations will largely hinge on the return on invested capital (ROIC) generated from these significant investments.

Current Valuation: PE 20x for FY26; ( Earlier Valuation: PE 20x)

Current TP: Rs 1,500/share; ( Earlier TP: Rs 1,500/share)

Recommendation: BUY

Financial Performance

Aurobindo Pharma's Q4FY25 results were in line with expectations. Revenue grew by 10.6% YoY and 5.1% QoQ, driven by strong performance in the US and European markets. Gross margins improved by 30 bps QoQ but declined by 50 bps YoY. EBITDA margins decreased by 70 bps YoY but improved by 128 bps QoQ. Reported profit stood at Rs 903 Cr, missing our estimate of Rs 1,026

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.