Buy IPCA Laboratories Ltd for the Target Rs.1,491 by PL Capital

Quick Pointers:

* Guidance of 10-12% growth in domestic business in FY27E.

* Unichem margins to touch 15% over 2-3years

Ipca reported strong EBITDA of Rs5.3bn (up 19% YoY) which was 10% above our estimates. Company has witnessed 400bps GMs expansion ex Unichme for 9MFY26 which should sustain given product mix and softer raw material prices. Export API business witnessed recovery in 9MFY26 with 26% YoY growth. Domestic formulation business, which now contributes 40% of revenues and ~55% of EBITDA, continued to outperform and grow at healthy levels. We believe 1) recovery in API segment 2) higher margins ex Unichem 3) steady growth in domestic formulation are the key growth drivers. At CMP, the stock is trading at 15x EV/EBITDA and 24x PE on FY28E adjusted for Unichem stake. We maintain our “Buy” rating on stock with revised TP of Rs1,710/share; valuing at 17x EV/EBITDA on FY28E.

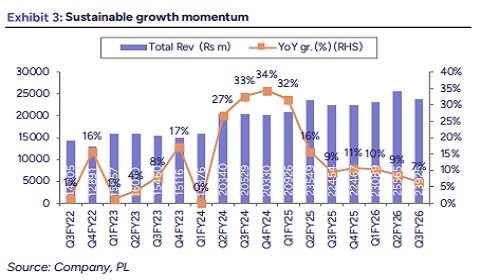

Ex Unichem revenues in line: IPCA’s revenues came in at Rs 24bn, up 6.6% YoY; broadly in line with our est. Ex Unichem, revenues grew by 9% YoY. Domestic formulations growth was 12% YoY. Export formulation was up 17% YoY at Rs 5.3bn above our est. Branded business was up by 28% YoY followed by generic business up 21.3% YoY. Institutional businesses were down 21% YoY. API sales remained flat YoY at Rs 4.1bn. Export API was up 6% YoY whereas domestic API declined 14% YoY. Revenues from subsidiaries, including Unichem were at Rs 5.6bn.

EBITDA beat aided by higher branded generic sales and GMs: Consolidated gross margins improved 230bps YoY and 300bps QoQ to 72.5%. There was forex loss to the tune of Rs 35mn booked under other expenses. Adj for forex; other expenses were up 2% YoY. Staff cost were up 12% YoY. EBITDA adj for forex gain came in at Rs 5.3bn, up 19% YoY; vs our est of Rs4.8bn. OPM came in at 22.1%, up 230bps YoY. Unichem margins at 8.6% (down 280bps QoQ). Adj for Unichem; EBITDA growth was at 35% YoY with OPM of 25.9%. PAT came at Rs 3.1bn; up 31% YoY

Key Conference Call Takeaways:

Domestic: Growth was backed by chronic segment followed by acute. Therapy wise growth: Pain contributes 50% of the mix was up (13%), CVS (16%), Anti Diabetes (14%), CNS (19%), Dermatology (22%), Urology (17%). Anti-malarials declined (-21%) but its contribution has reduced materially. Company is evaluating licensing opportunities in GLP1 rather than immediately pursuing in-house manufacturing. Mgmt expects domestic business to grow at 10-12% with steady margin expansion over 2-3years.

Unichem: US market share loss due to competition and price erosion will persist for 1–2 quarters before recovery. New launches from 2HY27E, with 4–5 molecules to be commercialized in 12–15 months, will support growth. Europe filings areprogressing, and margins should improve with volume ramp-up. Management guides for 8–10% growth, ~15% EBITDA in 2–3 years, and ~20% longer term as Europe scales.

US: Growth was largely on account of IPCA portfolio, especially backward integrated products. Uncertainties on generic portfolio more from the institutional business led to softness. Commercialised molecules have reached 25%+ market share. Intends to launch 5-7 products in 12-15months with focus to file 5-6 products annually.

Export formulations: Promotional branded business remains stable and high margin. West Africa performed strongly; Latin America grew 20%, Middle East & Africa 27%, East Asia 36%, while CIS was flat. Generic exports in Europe, Australia, New Zealand, and Canada are stable and profitable. The UK saw earlier price erosion, but prices have recovered 30–40% in some products recently. Europe exUK remains steady with healthy margins. Long-term export growth is guided at 10– 12%.

Biosimilars: Company initiated tech transfer for 2 products with manufacturing expected to begin shortly. It has 5 biosimilars under development.

API: Domestic API was impacted by lower anti-malarial demand and reduced contract manufacturing volumes. Realizations have stabilized and raw material prices remain steady. API remains the lowest-margin segment and is expected to grow slower than formulations.

Other highlights: Unichem has Rs 2.5bn cash after repaying Rs 1.8bn towards the EU fine and has no major capex planned. R&D productivity has improved, with higher filing intensity across the US, Europe, and ROW markets.

Above views are of the author and not of the website kindly read disclaimer