Buy INOX India Ltd For Target Rs. 1,240 By JM Financial Services

A strong legacy with some interesting prospects; initiate with BUY

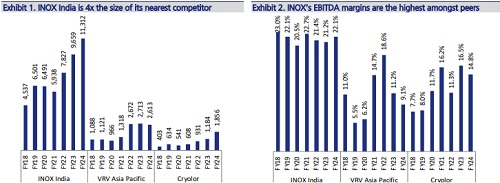

INOX India Limited is India’s largest manufacturer of cryogenic equipment, a dominant player, ~4x the size of its nearest competitor. Its key strengths are (1) 30+ years of expertise in engineering and design, quality management, and testing, (2) an impeccable execution track record, and (3) most globally required certifications in place, all of which make it a preferred supplier for its clients.

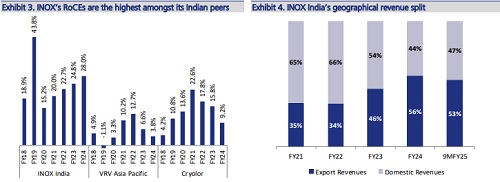

INOX operates in three business areas – Industrial Gas, LNG, and Cryo Scientific Division (CSD), of which industrial gases contributed 63% to FY24 revenue. Given the steady growth opportunities in Industrial Gas storage and transportation, orders in LNG and CSD, and contribution from the recently commenced kegs business, we forecast a FY24-27E EPS CAGR of 16% and average RoEs of 30%.

Based on a steady earnings growth, industry leading RoE and RoCEs, and most importantly, high cash flow translation, we value INOX India at 37x Mar’27E EPS, hence, arrive at a target price of INR 1,240. However, upsides exist from (1) the upcoming semiconductor ecosystem in India, (2) increasing demand for LNG as a truck fuel, and (3) full ramp up of the kegs business. (See page 07-11 for details).

Key risks are:

(a) inability to obtain regulatory approvals in new areas, (b) regulatory action, (c) cancellation or delay, in orders given the ongoing global uncertainty, and (d) dependence on product development for future success.

INOX is India’s largest manufacturer of cryogenic equipment…:

INOX is India’s largest manufacturer of cryogenic equipment with 30+ years of experience in cryogenic equipment and systems. It operates in three business divisions – Industrial Gas, LNG, and Cryo Scientific Division (CSD). The company has recently ventured into the manufacturing of stainless steel beverage kegs, and has set up a facility in Savli with an investment of INR 2bn. This business is expected to ramp up to 10% of revenues by FY27E. When compared to Indian peers, INOX’s FY24 revenues at INR 11.3bn, were ~4x of its nearest competitor (VRV Asia Pacific) and 6x of the other (Cryolor).

…and a leader in a regulated industry with barriers to entry…:

Stringency related to design and manufacturing and the number of regulations in the cryogenic equipment for each country are barriers to entry for new players in the segment. INOX India’s key strengths are (1) 30+ years of expertise in engineering and design, quality management, and testing, (2) an impeccable execution track record, and (3) most globally required certifications in place, all of which make it a preferred supplier for its clients

…run by a team of professional leaders:

While the Company is promoted by the Jain family, who participate in strategizing, it is run by a professional management, who have been with INOX for long years. Its CEO and CFO have been part since 1992 and 1993 respectively, while business heads; including industrial gases, LNG and CSD have been there since 1997, 1999, and 2011 respectively.

Initiate with BUY and TP of INR 1,240 per share at 37x Mar’27E EPS:

We initiate coverage with a BUY rating and a target price of INR 1,240 at 37x Mar’27E EPS; driven by an (1) EPS CAGR of 16%, (2) average RoE/RoCE of 30%/26%, and (3) average OCF/PAT and FCF/PAT conversion of 79% and 42% respectively through FY24-27E. However, opportunities in (1) semiconductors, (2) LNG trucking and (3) full ramp up of the kegs business, suggest upside risks.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361