Buy Havells India Ltd For Target Rs. 1,903 By Geojit Financial Services Ltd

A strong Q4…discretionary spending to pick-up

Havells India Ltd. (HAVL) is a leading player in electrical consumer goods in India. Its key verticals include switchgears, cables & wires, lighting fixtures, and consumer appliances.

• Revenue grew by robust 20% YoY exceeding our expectation, led by cables & wires and Lloyd, which grew by 21% & 40% YoY respectively.

• The switchgear and appliance segments saw modest growth, while emerging businesses continued to deliver high double-digit growth.

• Volatility in copper prices and an inflationary environment impacted discretionary spending. Additionally, a milder summer in South India compared to the previous year affected sales of cooling products.

• EBITDA grew by 20% YoY, with margins at 11.6%. Consequently, Net profit increased by 16.4% YoY.

• Going ahead, demand from the real estate and construction sectors will drive volumes of cables & wires. Further, The recent changes in income tax slab rates are anticipated to boost discretionary spending. While restocking and seasonal factors will drive overall growth going ahead

Outlook & Valuation

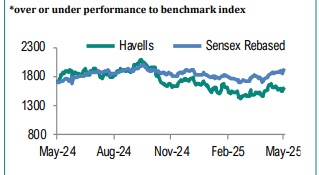

Given HAVL’s strong brand equity, diversified product portfolio, extensive distribution network, growing market share, and superior margin profile, we maintain a positive outlook on the stock. The stock is currently trading at a 1-year forward P/E of 54x, reflecting a 22% moderation in valuation from a recent peak of 69x. We project a 22% CAGR in earnings over FY25-FY27E. We value HAVL at a P/E of 54x on FY27E and reiterate our BUY rating with a target price of Rs.1,903

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345