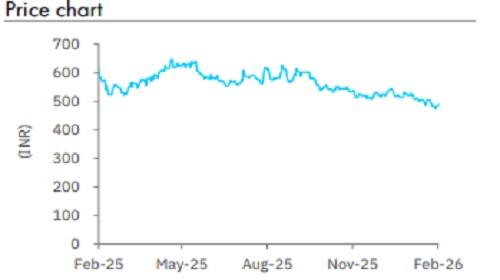

Buy Emami Ltd For Target Rs 640 By Elara Capital

Healthy core portfolio performance

Emami (HMN IN) reported 9.8% consolidated revenue growth in Q3, in line with our estimates. The growth was led by strong performance in the domestic business, which grew by 9% YoY and the international business, which also grew by 13.6% YoY. Domestic volume growth improved to 9% YoY as GST-related disruptions subsided and on loading of the winter portfolio. Management expects 8-10% revenue growth, aided by recovery in rural growth, and portfolio relaunches. We have cut our EPS for FY26E by 3.1% but raised our FY27E/FY28E estimates by 6.2%/6.7% respectively, factoring in tax benefit for the domestic business in respective years. We retain Buy with a lower TP of INR 640 based on 30x (from 35x) December 2027E as we see the risk of an erratic summer affecting the seasonal portfolio of the business

Domestic business – Strong core portfolio performance: HMN’s Q3 sales grew 9.8% YoY, in line with our estimates, to INR 11.52bn as domestic sales grew 9% YoY and international business grew 13.6%. Domestic volume growth was 9% YoY as winter offtakes have been healthy across the portfolio due to a favorable season. The core-domestic portfolio grew due to strong performance in BoroPlus (16%), pain management range (8%), Kesh King (10%), 7 Oils in One (41%), healthcare (7%) and male grooming (4%). Strategic subsidiaries (Man Company & Brillare) delivered growth of 31% in Q3 and may likely sustain the growth momentum due to strong performance in quick-commerce and D2C websites. Male grooming, contributing 4-5% of sales, and sitting on a low base, may see double-digit growth this year. International business recorded sales growth of 13%, led by steady performance in SAARC (40%), MENA (44%) and CIS (9%). Bangladesh saw a double-digit recovery, although primary sales remain weak due to high inventory, and growth was dragged down by certain markets such as Iraq.

Quick-commerce channel growing faster; focus on throughput per store: Quick-commerce sales have doubled and now contribute 20% of the e-commerce business, with organized trade contributing 32% of total sales. Management highlighted that the General Trade channel remains more profitable than organized channels due to lower promotional spends. On the distribution front, the company maintains a direct reach of 450,000 outlets and will be focusing on increasing throughput per outlet rather than further footprint expansion

Margin expansion led by favorable tax outlook: Gross margin stood at 70.6%, up 34bps YoY while EBITDA margin expanded 108bps YoY to 33.4% (70bps below our estimates). Expansion was driven by lower other expenses, employee costs, and reduced ad-spends. Post Budget ’26, the effective tax rate for the company is expected to be 20% for FY27E and beyond, while for the domestic business, it would be reduced to 25%. Amortization is likely to continue for three-four years (INR 700-800mn per year).

Retain Buy, TP lowered to INR 640: We have cut our EPS for FY26E by 3.1% but raised our FY27E/FY28E estimates by 6.2%/6.7% respectively, factoring in tax benefit for the domestic business. We retain Buy with a lower TP of INR 640 from INR 700, based on 30x (from 35x) December 2027E, as we see the risk of an erratic summer affecting the seasonal portfolio of the business.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)