Buy Angel One Ltd for the Target Rs. 2,900 by Motilal Oswal Financial Services Ltd

Continued recovery in broking; beat on PBT due to cost control

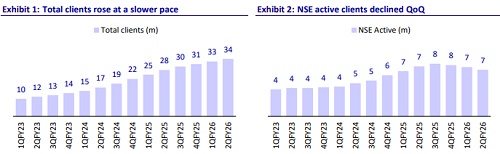

* Angel One (ANGELONE) reported total income at INR9.4b (down 21% YoY but grew 6% QoQ), which was in line with our estimates. For 1HFY26, total income declined 21% YoY to INR18.3b.

* Total operating expenses grew 3% YoY (in line) to INR6.2b. The CI ratio increased to 65.5% vs. 50.1% in 2QFY25, with employee expenses up 19% YoY while admin expenses declined 8% YoY. Operating profit for 2QFY26 came in at INR3.2b, reflecting a margin of 34.5% (49.9% in 2QFY25). For 1HFY26, the operating margin stood at 28% (44% in 1HFY25).

* Controlled costs with flat sequential employee expenses and a decline in customer acquisition resulted in a 6% beat on PBT. However, a higher tax rate resulted in an in-line PAT of INR2.1b, which was down 50% YoY/up 85% QoQ. For 1HFY26, ANGELONE’s PAT declined 54% YoY to INR3.3b.

* Sustained improvement in order run rate, continued traction in distribution, and MTF book expansion should boost revenue growth. Cost efficiencies coupled with the revenue momentum should help in achieving an exit operating margin of 40-45% in FY26.

* We have increased our 27/28 EPS estimates by 4%/11%, considering strong traction in distribution revenue, cash brokerage revision, and MTF book expansion offset by an increase in customer additions. We roll over to Sep’27E EPS to arrive at our TP of INR2,900 (premised on 18x Sep’27E EPS). Reiterate BUY.

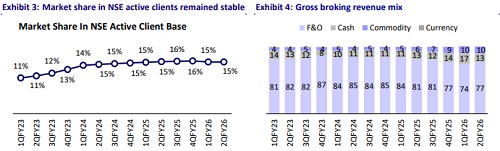

F&O, commodity, and distribution drive sequential revenue growth

* Gross broking revenue at ~INR7.2b declined 23% YoY/grew 4% QoQ (in line). The sequential growth in brokerage revenue was led by F&O activity (F&O brokerage rose 8% QoQ and was in line), while cash brokerage declined 21% YoY/16% QoQ (17% miss). The commodity brokerage rose 28% YoY/5% QoQ (8% miss).

* ANGELONE’s 2QFY26 witnessed a continued rise in F&O activity after the resetting of the base post-F&O regulations in 4QFY25, with the company reporting a 7% sequential increase in F&O orders to 258m. Revenue per order was consistent at INR21.4.

* A volatile market environment resulted in a 3% sequential decline in cash orders to 73m. However, revenue per order declined QoQ to INR13.2.

* A surge in commodity activity resulted in a 7% sequential growth in commodity orders to 30m.

* Average client funding book witnessed a substantial growth of 26% QoQ to INR53.1b (INR42.1b in 1QFY26). Net interest income grew 5% QoQ to INR2.9b. The exit MTF book for 2QFY26 stood at INR59.5b.

* Distribution income grew 70% YoY/40% QoQ, backed by 1) ~100% sequential growth in credit disbursals to INR4.6b during the quarter (INR13.9b – cumulative as of Sep’25); 2) a strong IPO pipeline during the quarter; and 3) wealth AUM reaching INR61.4b with >75% ARR AUM.

* Asset management AUM stood at INR4b spread across seven live schemes. The number of folios has grown 50% QoQ to 138,000.

Costs under control; operating margin at 34.5%

* ANGELONE’s total operating expenses grew 3% YoY to INR6.2b with 19% YoY growth in employee expenses, offset by an 8% YoY decline in admin expenses.

* The CI ratio increased to 65.5% in 2QFY26 from 50.1% in 2QFY25.

* Employee costs included ESOP costs of INR470m and employee benefit expenses of INR2,275m.

* Admin and other expenses declined 8% YoY to INR3.4b, owing to a decline in customer additions to 1.7m during the quarter (3m in 2QFY25)

Highlights from the management commentary

* The recent price revision was implemented to simplify pricing for customers — delivery and intraday trades are now priced between a minimum of INR5 (earlier INR2) and a maximum of INR20/order. This should add INR500–600m annually to revenue.

* The MTF book can double the current balance sheet strength, with the current debt-to-equity at a comfortable level.

* The broking business is expected to clock a ~25% CAGR, while newer businesses (distribution, wealth, AMC, and insurance) are anticipated to contribute doubledigit share to revenue, helping diversify its overall revenue. In the long term, OPM is projected to expand to 45–50% as emerging businesses scale up

Valuation and view

* Sequential growth momentum was maintained in 2QFY26, with the industry seeing recovery in F&O activity and a strong surge in commodity activity, offset by a volatile market impacting the retail cash activity. Costs were controlled with flattish employee expenses and a decline in customer acquisition costs.

* The new business of loan distribution witnessed strong growth during the quarter. Other new businesses, such as the credit distribution, wealth management, and AMC, are likely to gain traction, which, coupled with continued momentum in the broking business, can improve operating margins to 40%+, going forward. However, tightening of F&O regulations remains a key risk for the growth momentum of the broking segment.

* We raise our FY26/FY27/FY28E EPS by 1%/4%/11%, considering strong traction in distribution revenue, cash brokerage revision, and MTF book expansion, offset by an increase in customer additions. We roll over to Sep’27E EPS to arrive at our TP of INR2,900 (premised on 18x Sep’27E EPS). Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412