Buy Amber Enterprises Ltd For Target Rs.7,800 by Motilal Oswal Financial Services Ltd

Two steps forward, one step backward

Amber Enterprises (Amber) reported better-than-expected revenue and EBITDA in 3QFY25; however, PAT came in line with our estimate due to losses from subsidiaries. Revenue/EBITDA improved 65%/102% YoY, led by the consumer durables and electronics segments, while railways continued to decline. Consumer durables, particularly the RAC segment, witnessed strong growth, driven by overall healthy RAC demand and client additions. The electronics segment’s performance too remained strong, aided by a strategic focus on increasing diversification and the client base. However, the railways segment’s performance was impacted by delays in offtake and design changes from IR. We expect Amber to continue to benefit from growth in the RAC segment and faster growth in the electronics segment, driven by new client additions, JV with Korea Circuit, and capacity expansion across Ascent Circuit. The company is also planning to participate in the upcoming component PLI scheme via its JV with Korea Circuit, with a focus on tapping a much bigger EMS market. We cut our EPS estimates by 9%/3%/2% for FY25/FY26/FY27 to bake in slower growth in the railways segment. Maintain BUY with a revised DCF-based TP of INR7,800 (from INR7,900 earlier).

Strong revenue growth with in-line PAT in line

Amber posted relatively stronger numbers in 3QFY25, with EBITDA margin expanding 130bp YoY and PAT margin turning positive at 1.7%. Consolidated revenue grew 65% YoY to INR21.3b, beating our estimate by 16%, mainly due to higher demand in the consumer durables and electronics segments. Absolute EBITDA jumped 102% YoY to INR1.58b, beating our estimate by 22%, while the margin expanded 130bp YoY to 7.4% vs. our estimate of 7.1%. PAT stood at INR359m, 1% above our estimate of INR354m. PAT margin was 1.7% vs. our estimate of 1.9%. Despite a beat on revenue and EBITDA, PAT came largely in line due to a higher share of losses in joint ventures.

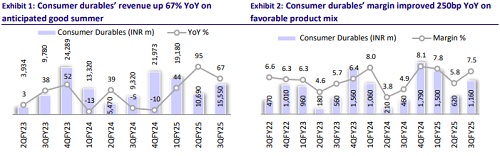

Consumer durables growth driven by anticipation of good summer

The consumer durables segment’s revenue grew strongly by 67% YoY in 3Q to INR15.6b, EBITDA jumped 150% YoY to INR1.16b, and margin expanded 250bp YoY to 7.5% (vs. 5.0% last year). This growth was led largely by channel inventory filling in the underlying RAC industry in anticipation of a good summer season. The order book grew stronger for commercial ACs, aided by an increased customer base and the strengthening of few customer relations to full ODM solutions. Revenue from RAC and RAC components surged 71% YoY, while revenue from non-RAC grew 43% YoY. Management also stated that its JV with Resojet for the manufacturing of washing machines is set to begin mass production by 1HFY26. Furthermore, Amber is constantly incurring capex to expand its product portfolio and ramp up the component segment. We believe all these steps will drive a CAGR of 22%/27% in revenue/EBITDA over FY24-27.

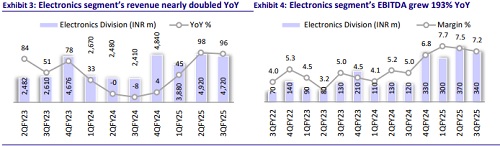

Electronic segment performance to further improve once capex gets over

The electronic segment’s revenue grew 96% YoY, driven by stable demand momentum across key focus areas, such as automobile, IT and telecom, industrial, defense and aerospace from Ascent Circuit, and traditional consumer durables. The company also bagged new orders for defense and renewable energy for PCBA. Electronic segment growth in future would be driven by both PCBA and PCB manufacturing; hence, the company is also planning incremental capex of INR6.5b for adding up to 840,000 SqM annual capacity through its subsidiary, Ascent Circuit, at Hosur, Chennai. Along with this, the company’s subsidiary IL JIN’s JV with Korea Circuit is planning to apply for the government’s upcoming component policy (ISM2.0) for capex for HDI, Flex and semi-conductor substrate manufacturing. The company expects to infuse nearly INR10b, subject to support from the central and state governments, and it is targeting an asset turnover of 1-1.25x from the facility. Once all approvals are received, we expect this facility to contribute nearly INR10- 12b of incremental revenues for the electronics division. With this, the company expects benefits of backward integration for the electronics segment and expects margins to reach double digits over time. We expect the electronics segment’s revenue/EBITDA to report a CAGR of 45%/73% over FY24-27.

Railways segment’s delayed revival expectation

The railway segment’s revenue was weak at INR1.1b, down 13% YoY, while EBITDA decreased 51% YoY to INR0.12b, with margins contracting to 11.2% (vs. 19.7% last quarter). This was mainly due to the deferral in the offtake of products for projects, such as Metro and Vande Bharat. However, the government has now given clearance for Vande Bharat coaches and the Mumbai Metro project is back on track as well. Thus, the management expects a revival in the segment in 2HFY26, bringing the margins back to the range of 18-22%, supported by 1) the existing order book, 2) the execution of orders for Vande Bharat and Mumbai Metro projects, 3) the commencement of Sidwal’s greenfield facility by 2QFY26, and 4) the set-up of the Yujin JV production facility, which is expected to be completed by 1QFY26 with product trials to begin from 2Q/3QFY26. We expect the railways segment’s underperformance to continue in FY26 and expect it to start growing after FY26. We expect the segment’s revenue/EBITDA to clock a CAGR of 15%/12% over FY24-27.

Financial outlook

We cut our EPS estimates by 9%/3%/2% for FY25/FY26/FY27 to bake in weak performance of railways on both execution as well as margins in FY25 and FY26. We thus expect a CAGR of 26%/33%/62% in revenue/EBITDA/PAT over FY24-27 for Amber.

Valuation and view

We cut our EPS estimates by 9%/3%/2% for FY25/FY26/FY27 to bake in weak performance of railways on both execution as well as margins in FY25 and FY26. We thus expect a CAGR of 26%/33%/62% in revenue/EBITDA/PAT over FY24-27 for Amber.

Valuation and view

The stock currently trades at 63.7x/41.4x P/E on FY26E/FY27E earnings. We downgrade our estimates and reiterate our BUY rating on the stock with a DCFbased TP of INR7,800, implying 46x P/E on a two-year forward EPS (Mar’27E).

Key risks and concerns

Key risks and concerns include lower-than-expected demand growth in the RAC industry; change in BEE norms making products costlier; and increased competition across the RAC, mobility, and electronics segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412