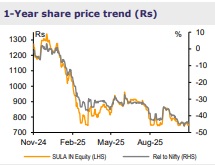

Add Sula Vineyards Ltd for the Target Rs.275 By Emkay Global Financial Services Ltd

Regulatory stability key for growth recovery ahead

We retain ADD on Sula with Sep-26E TP of Rs275, on 28x P/E. Unlike in the developed world, wine as a category is still nascent, at only <1% of the alcobev industry volume. We see Sula playing a crucial role in the development of the wine category. After the Australia FTA, there is a likelihood of a European FTA, after which Sula would look to expand its imported wine portfolio, while aiming to keep it remunerative (vs a margin-dilutive proposition in the past). Q2 revenue dipped 1% YoY (affected by Telangana sales; adjusted revenue grew in a mid-single digit), while the weaker margin (adverse state mix, change in wine sourcing accounting, and high-cost inventory) pushed down EBITDA by 24%. With regulatory (state policies) and accounting (for wine sourcing for tourism) headwinds arresting from Q3, the mgmt is hopeful of growth and margin recovery ahead. We see healthy earnings in 2HFY26, on a low base.

State disruption continues to mar performance

Sula has reported 1% decline in revenue from operations, with own-brand revenue seeing a 2.5% decline. This fall is owing to temporary route-to-market disruption in Telangana (with ~15% revenue mix); adjusted revenue growth stood at a mid-single digit. With Telangana retail set to bounce back to normalcy from Dec-25, we expect offtake to see improvement from Q4FY26. Amid own brands (89% of revenue), Sula’s Elite and Premium offerings saw 3% YoY decline; here, double-digit growth was seen in eight states, including Haryana, Rajasthan, and Uttar Pradesh. The Source range (10% mix) continues to thrive with healthy double-digit growth. Revenue in the economy and popular segment stood firm YoY at Rs275mn, where its Samara and Port brands saw double-digit growth. Wine tourism (~9% of revenue) saw 7.7% YoY revenue growth. Sula has opened its 3rd resort – The Haven by Sula (30 keys), in Sep-25. Occupancies for Q2 saw a 300bps YoY expansion to 77%, while ARR improved 1% YoY to Rs9,788.

Weak gross margin hurts EBITDA delivery

Gross margin as a % of gross sales contracted by 925bps YoY and 400bps QoQ to 64.6%. the management attributed the YoY decline to i) ~400bps impact from the weaker market and portfolio mix, ii) ~400bps hit due to change in the wine sourcing model for wine tourism (base to normalize from Q3FY26), and iii) high-cost inventory (balance impact; to see recovery from Q3). Cost optimization measures helped arrest the EBITDA margin contraction at ~595bps YoY (at 19.4%), up by 270bps QoQ. The management sees EBITDA margin improving from 2HFY26, with higher WIPS income, phasing out of highcost inventory from last year, and normative profitability in ‘wine tourism’.

Driving growth key ahead; maintain ADD

We expect enhanced efforts from Sula toward developing the wine category. The management expects improving traction for imported wines with the European FTA, and is strategizing to widen the imported brand portfolio.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354