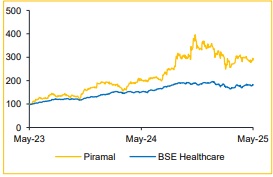

Add Piramal Pharma Ltd For Target Rs. 235 - Choice Broking Ltd

Long-Term Growth Intact, Near-Term Weakness from CDMO Delays & Cost Pressures

While PIRPHARM remains on track to achieve its long-term goal of doubling revenues from USD 1 Bn in FY25 to USD 2 Bn by FY30, the near-term outlook has softened. Management has revised its FY26 guidance downward due to delays in CDMO order inflows and elevated operating expenses linked to the new facility, which are expected to weigh on EBITDA growth. We expect margins to expand only moderately in FY26. In light of this, we revise our earnings estimates downward by 12.3%/11.5% for FY26E/FY27E, and downgrade our rating to ADD with a revised target price of INR 235 (from INR 315 in Q3FY25). We apply a multiple of 40x FY27E EPS, in line with comparable peers.

Sequential Boost from CDMO, But Consensus Miss on Revenue and PAT:

Revenue grew 7.9% YoY / 24.9% QoQ to INR 27.5 Bn (vs. consensus estimate: INR 28.7 Bn), driven by strong sequential growth in CDMO due to seasonality. EBITDA rose 5.9% YoY / 66.1% QoQ to INR 5.6 Bn (vs. consensus estimate: INR 5.8 Bn); margins contracted 39 bps YoY / expanded 505 bps QoQ to 20.4% (vs. consensus: 20.3%). PAT increased 51.6% YoY to INR 1.5 Bn, aided by tax rate normalization (vs. consensus estimate: INR 1.8 Bn).

Piramal on Track to Double Revenues by FY30; Strong Momentum Across Segments:

Piramal is progressing well toward its target of doubling revenues from USD 1 Bn in FY25 to USD 2 Bn by FY30, with an EBITDA margin goal of 25%. This growth is expected to be broad-based across all three segments:

* CDMO: Reported strong traction with 39.9% QoQ growth in Q4. We expect the segment to grow at a 5-year CAGR of 14%, led by innovation-focused CDMO services, which now account for 54% of FY25 segment revenues.

* CHG: Growth continues on the back of the Inhalation Anesthesia portfolio. Piramal holds a 44% market share in Sevoflurane and 75% in Baclofen in the US. The Digwal facility expansion is now complete, enabling increased Sevoflurane production and launches in RoW markets. We project a 13% CAGR for FY25–30E.

* ICH: The segment crossed INR 1,000 Cr in FY25, with 20% YoY growth in power brands, which now form 49% of segment revenue. We expect a 5-year CAGR of 9.7%, supported by growth in power brands, new launches, and ecommerce ramp-up.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131