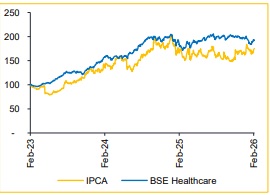

Add IPCA Labs Ltd for the Target Rs.1,585 by Choice Institutional Equity Limited

Stable Growth Outlook with Margin Improvement

While IPCA’s overall revenue growth outlook remains unchanged — high single digit growth in FY26 and low teens growth in FY27 — we expect this to be driven by US launches and a favourable therapy mix shift. That said, we anticipate a stronger margin profile supported by improved product mix, greater backward integration from the API segment and breakeven in Unichem. We expect ~160bps margin expansion in FY26. While management guides for 100–150bps annual expansion contingent on 10–12% revenue growth, we adopt a more conservative stance as we monitor execution of these strategic initiatives. With the effective tax rate now expected at ~25% (from 30% earlier) and lower interest costs, we revise our FY26/27E EPS estimates upward by 5.3%/7.0%. We continue to value the stock at 25x average FY27–28E EPS, resulting in a revised TP of INR 1,585 (from INR 1,410), and maintain our ADD rating.

Steady Operating Performance with Margin Expansion

* Revenue grew 6.6% YoY / declined 6.4% QoQ to INR 23,925 Mn (vs. CIE estimate: INR 24,275 Mn).

* EBITDA grew 15.2% YoY / declined 2.1% QoQ to INR 5,334 Mn; margin expanded 167 bps YoY / 98 bps QoQ to 22.3% (vs. CIE estimate: 21.7%).

* PAT grew 31.5% YoY / 15.5% QoQ to INR 3,263 Mn (vs. CIE estimate: INR 3,140 Mn).

* The company recorded an exceptional gain of INR 177 Mn related to disposal of land & building.

FY27 Rebound Expected; Formulations to Drive Momentum

While the company has delivered moderate growth in 9M, we believe the overall outlook remains constructive, with growth expected to re-accelerate from FY27.

* Formulations: The segment delivered healthy growth in 9M, and we expect the momentum to sustain, supported by a favourable therapy mix shift in India; continued traction in South Africa and LATAM; 5–7 new launches in US generics and recovery in Unichem.

* API: Given the inherently more cyclical nature of this segment, we expect comparatively slower growth, driven primarily by anti-malarial demand and normalisation of bulk orders. Strategically, the API business is likely to play a larger role in supporting backward integration, strengthening margin.

Operating Leverage to Drive ~160bps FY26 Margin Expansion

EBITDA margin continued on their expansion trajectory and we expect this to sustain into FY26, with margin seen at ~21% (~160 bps YoY expansion). This improvement should be supported by breakeven at Unichem, along with a favourable product mix shift, driven by higher contribution from branded exports and benefits from backward integration. Management has guided for a 100–150 bps annual margin improvement, contingent on sustaining 10–12% revenue growth, implying continued operating leverage as scale improves

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131