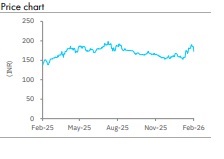

Buy PTC India Ltd For Target Rs.210 By Elara Capital

Lower surcharge income drags earnings

PTC India (PTCIN IN) reported INR 33 bn revenue from operations in Q3FY26, up 4% YoY, while EBITDA declined 24.5% YoY to INR 506 mn and other income fell 37.2% YoY to INR 691 mn . Surcharge income recognized during the quarter stood at INR 220 mn compared with INR 1,052.2mn in Q3FY25, and surcharge expense included under finance costs was INR 24.9 mn versus INR 258.6 mn last year. There was a 25% YoY drop in reported PAT to INR 827 mn . Total electricity trading volume increased 4% YoY to 20,010MU, with short -term volume at 13.4BU and long - and medium -term volume at 6.6BU, constituting 33% of the overall mix . Short -term trading margin was INR 0.0087 per unit and long -term margin was INR 0.0791 per unit.

Reported PAT declined 25.2% YoY: Revenue from operations increased 4% YoY to INR 33bn. PTCIN has recognized surcharge income of INR 220mn in Q3FY26 (versus INR 1 ,052.2mn for Q3FY25) . Surcharge expense of INR 24.9mn paid / payable to the suppliers in Q3FY26 ( versus INR 258.6mn in Q3FY35) has been included in finance costs . EBITDA declined 24.5% YoY to INR 506mn. Other income declined 37.2% YoY to INR 691mn. Reported PAT dropped 25% YoY to INR 827mn.

Trading volume rose 4% YoY: Total electricity volumes increased 4% YoY to 20,010MU in Q3FY26. Short -term volume stood at 13. 4BU in Q 3FY26. Long - and medium -term volume stood at 6.6BU in Q 3FY26. Long - and medium -term constituted 33% of the total volume mix. Trading margin in the short term was at INR 0.008 7 per unit in Q 3FY26. The long -term margin was at INR 0.07 91 per unit in Q 3FY26. Cash balance was INR 32.92 was INR 32.92bn and ~ INR 20bn is required to support the working capital needs of the trading business.

Market coupling positive for PTCIN: Revenue from HPX stood at INR 86.4mn in Q3FY26. HPX reported a loss of INR 24.6mn in Q3FY26 due to higher technology and manpower expenses. 9MFY26 revenue was at INR 364mn with PAT of INR 44.2mn. The Appellate Tribunal for Electricity directed the Central Electricity Regulatory Commission to frame regulations before implementing market coupling . The management is of the view that implementation of market coupling will unlock significant value.

Retain Buy; TP unchanged at INR 210: We value standalone operations at INR 68 per share on 6x FY2 8E P/E. We ascribe a value of INR 36 per share to PTCIN’s investment in PFS, INR 11 per share to its investment in HPX, INR 7 per share for other investments and INR 89 to cash and cash equivalents. Retain Buy with an unchanged TP of INR 210. We believe implementation of market coupling will have a positive impact on PTCIN’s trading volume. We have revised our earnings estimates downwards factoring in lower surc harge income.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)

.jpg)