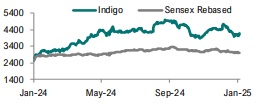

Buy InterGlobe Aviation Ltd For Target Rs.4,814 By Geojit Financial Services Ltd

Strong fleet addition...outlook strong

InterGlobe Aviation Ltd. (Indigo) is one of the most efficient low cost air carriers (LCCs) with a market share of 62% in the Indian aviation sector.

* In Q3FY25, revenue grew by 14% YoY, which was better than anticipated, led by a 13% YoY rise in passenger volumes.

* EBITDA was flat due to higher forex loss on account of INR depreciation, higher lease expenses, costs due to grounding of aircraft and airport fees.

* The net aircraft addition was 27, taking the total fleet count to 437. Management has guided a 20% YoY increase in capacity in Q4FY25.

* Going ahead, passenger growth outlook remains strong in Q4, while long term outlook remains intact, led by a strong domestic network and gradual increase in the international network. The operational cost is likely to remain elevated for some more time due to the grounding of aircrafts.

* We lower our EPS estimates by 11.2% & 11.3% for FY25 & FY26E as we factor in higher costs.

Outlook & Valuation

We continue to maintain a positive view on Indigo, given the robust outlook for the sector, its market leadership position (62%), ability to leverage its extensive network, cost-efficient fleet, and healthy cash position. Looking ahead, a strong domestic network and increasing penetration in international markets will drive growth.We value Indigo at a P/E of 21x as we roll forward to FY27E (7.4x EV/ EBITDA) and maintain BUY with a target price of Rs.4,814

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345