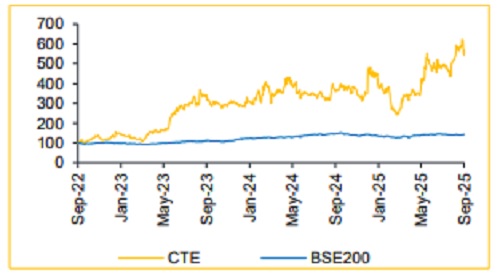

Add Centum Electronics Ltd for the Target Rs.3,000 by Choice Broking Ltd

Key Takeaways from Plant Visit-cum-Management Meet:

We recently visited Centum Electronics Ltd. in Bengaluru and had an insightful interaction with the top management, including Mr. Apparao V. Mallavarapu (Chairman & MD), Mr. Nikhil Mallavarapu (Joint MD), Mr. Vishwanath Mudegowdara (CEO, Centum T&S), Mr. Sundararajan Parthasarathy (CFO) and other senior officials. Our key observations are: 1) Ongoing transformation from an EMS player to a strategic defence electronics partner 2) Sole supplier of critical space systems and sub-systems for ISRO 3) Increased focus on Build-to-Specs business 4) Restructuring of the Canadian subsidiary to streamline operations 5) Diversification to emerging high-growth sectors. We maintain an ‘ADD’ rating, with an upgraded TP of INR 3,000

1) Transformation to strategic partner: After the visit, our conviction on CTE has strengthened meaningfully backed by their diversified business model and long-cycle, mission-critical programs, where barriers to entry is high. In our view, CTE is no longer just an EMS company; it is transforming into a strategic electronics partner for defence, aerospace, space and high-tech industries.

2) Sole supplier for ISRO: We have observed CTE’s long-standing track record with ISRO and its involvement in nearly every launch program. It has a distinct competitive edge being the sole supplier for several critical components to ISRO. CTE’s components, systems and sub-systems have contributed to landmark missions, including India’s successful moon landing and the Aditya-L1 program. The firm is poised to benefit as India and global space economies expand.

3) Focus on Build-to-Specs: CTE’s work on electronic warfare payloads, radar TR modules, missile avionics and tank modernisation programs is not only strategically critical but also ensure multi-decade program stickiness. The CTE’s ongoing transition, from PCB assemblies to subsystem and full ‘box-build’ solutions, will enhance its wallet share.

4) Restructuring of subsidiary: CTE’s Canadian subsidiary is undergoing restructuring. The management has indicated that the business model is being revised and expects the process to be completed over the next few quarters.

5) Diversification to high-growth sectors: We are positive on the company’s adjacency bets in clean energy, battery management, medical imaging and semiconductor equipment. These are not side businesses but strategic moves into secular growth areas. We expect them to contribute meaningfully over the next 3–5 years, adding resilience and optionality, with CTE positioned at an inflection point of converging growth drivers.

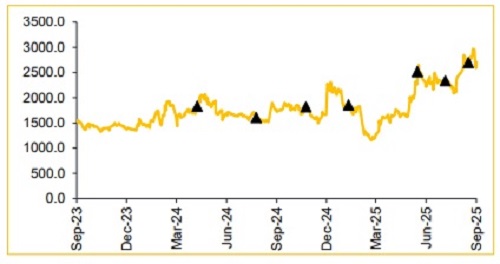

View & Valuation: We maintain our positive view on CTE, expecting Revenue/EBITDA/PAT to expand at a CAGR of 19%/29%/51%, respectively, over FY26–28E. Looking into its business prospects, we have increased our PE multiple to 35x (from earlier 30x). We value the stock on average EPS of FY27–28E and, given the recent rally, we maintain our ‘ADD’ rating with the target price upgraded to INR 3,000 (from earlier INR 2,570).

We will continue to closely monitor CTE. Any positive development on the restructuring process could prompt us to reassess our stance.

Key Risks:

1) High revenue dependence on EU; tariffs or trade barriers could impact exports. 2) Canadian subsidiary restructuring, if delayed, may hurt financials. 3) High client concentration.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131