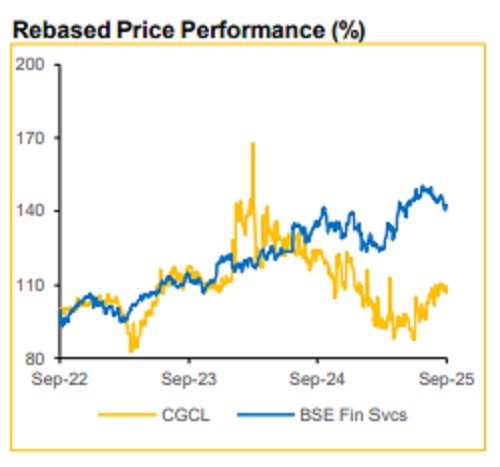

Buy Capri Global Capital Ltd for the Target Rs.640 by Choice Broking Ltd

Higher Yields and Lower Costs will Lead to Margin Expansion

CGCL has undergone a transformation from a single product, geographically concentrated Loan Book to a geographically & portfolio diverse AUM. This diversification was achieved via high growth in existing products like Construction Finance & Housing Finance growing at a CAGR of ~44% and ~48% respectively over FY22 to FY25. Further, the successful launch of Gold Loans via an addition of 562 branches in FY23, growing the branch base significantly led to consolidated 3 year AUM CAGR of ~51% over the same period. Gold Loans are the highest yielding product, improving portfolio yields by ~155 bps over FY23 to FY25. We forecast CGCL will be able to sustain these higher yields as Gold Loans now form a significant ~36% of the total AUM. Further, a rating upgrade is likely to improve Cost of Funds; whereas more efficient branch unit-economics & operational leverage will expand NIMs & improve the cost to income ratio.

Enhanced Retail Credit Push through Technology & QIP

A 100% digital onboarding process for most of its products offers opportunities for meaningful scale. Over the last 3 years, CGCL has invested ~INR 3000 – 4500 Mn for implementing a technology platform that now forms a core part of their operations, the platform covers the entire suite of customer engagement, from Onboarding to Collections. With integration of AI, Analytics the platform is future ready. It has stream-lined the operating processes, with benefits such as significant TAT reduction, increased customer engagement, higher cross-selling opportunities and better collections. CGCL completed its QIP of INR 20 Bn in June 2025, at INR 146.50/share offering shares to key marquee investors and charting a runway for non-dilutive medium-term growth.

RoA Uptick Powered by Diversified Revenue Streams

Car Loan Originations, Insurance Distribution and Co-Lending Income form a main part of Non Interest Income. With total Non Interest Income coming in at an average of ~37% of Net Interest Income(NII). CGCL has been able to successfully scale these smaller streams of Income into RoA drivers. For FY25, CGCL had partnerships with 12 banks for its car loan origination platform, generating a Net Fee Income of INR 0.9 Bn, 7.2% of NII. Co-Lending model generates a 4% yield on off book AUM generating an income of INR 1.65 Bn in FY25, 12.5% of NII. Similarly, Insurance Distribution nets the company 5.5% of NII. We expect RoA to improve by 158bps over FY25—FY28E with NII adding 114bps and 12 bps incrementally contributed by Non Interest Income.

Valuation & View

We value CGCL using the Residual Income Approach. We calculate Cost of Equity to be at 11.3% with ROEs projected to reach 18.3% by FY28E supported by Income Growth & softening costs. We initiate coverage with a “BUY” rating and upside of 22%, implying P/ABV of 2.9x / 2.5x of FY27E/FY28E.

Key Risks

Co-Lending Policy Changes, Possible downturn in economic conditions leading to higher MSME delinquencies, slower-than-expected loan growth, fluctuations in gold price

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd ( 1 ).jpg)