Reduce Motherson Sumi Wiring India Ltd for the Target Rs.48 by Choice Broking Ltd

View and Valuation:

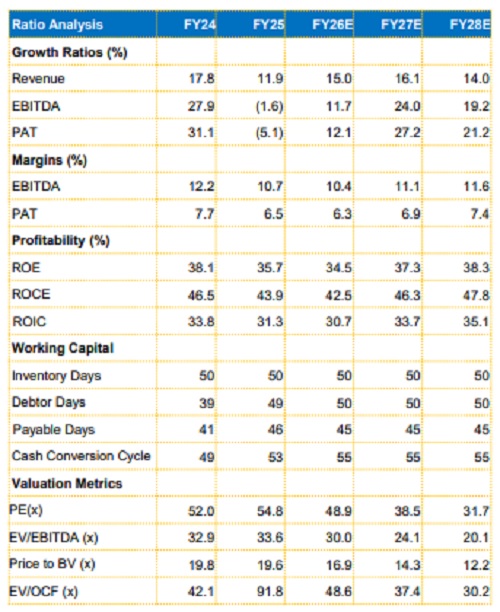

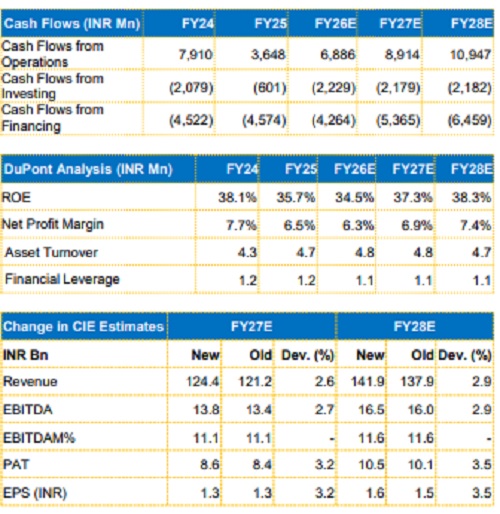

We remain positive on the long-term opportunity as the company is well-positioned to benefit from the industry’s shift towards EV and hybrid powertrains. These are expected to increase the content per vehicle, as the content value for EV programs in passenger vehicles is approximately 1.5 to 1.7 times higher than ICE vehicles. We revise our FY27/FY28 EPS estimates upwards by 3.2%/3.5% and arrive at our target price of INR 48. We value the company at 33x (previously 30x) on the average FY27/28E EPS and change our rating to REDUCE from ADD.

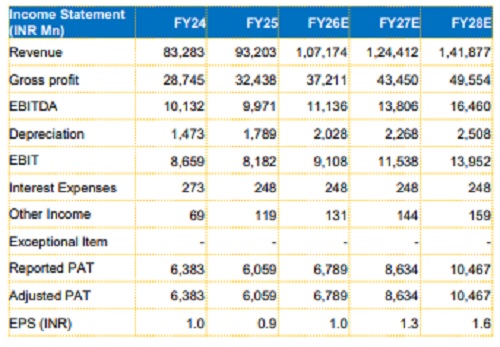

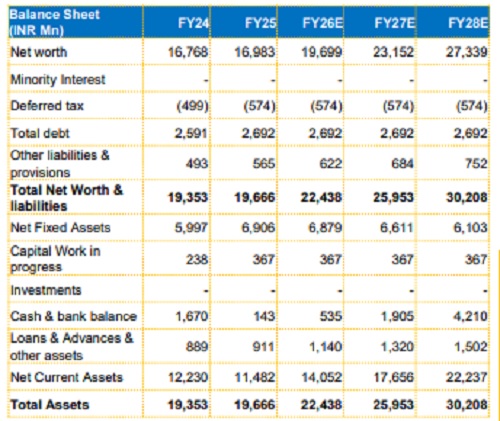

Financials:

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131