Reduce Uno Minda Ltd for the Target Rs.1,215 by Choice Broking Ltd

View and Valuation:

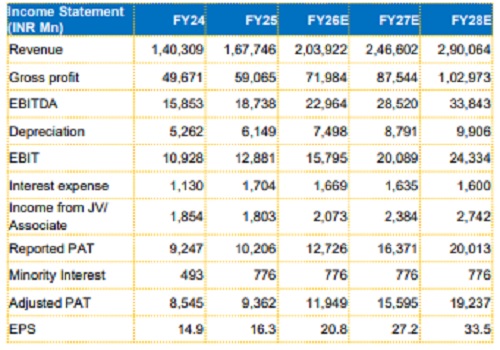

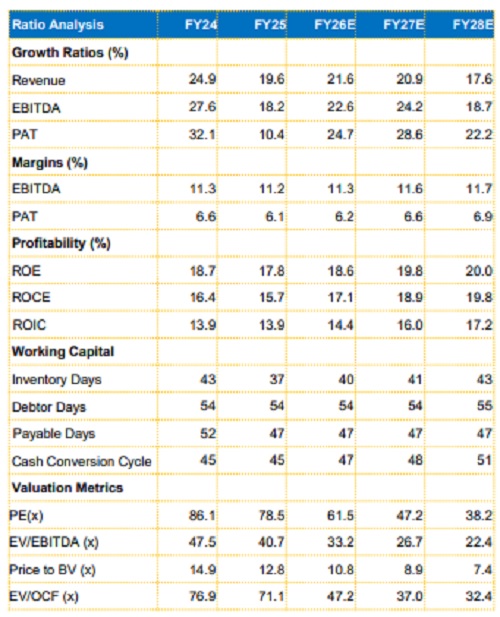

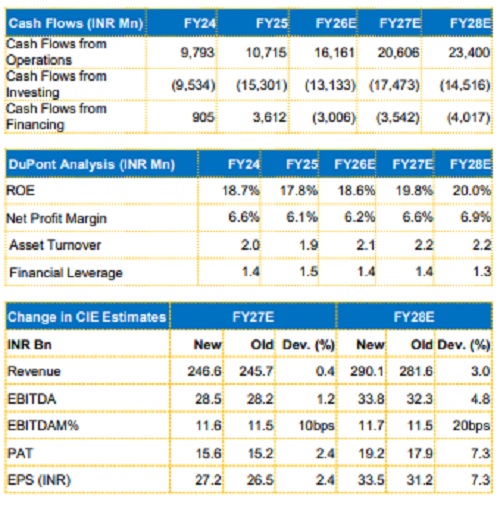

UNOMINDA is well-positioned to capitalize on structural tailwinds from premiumization and shift towards electric vehicles in the auto components sector, supported by strategic investments in high growth areas, thereby enhancing long-term growth visibility. We revise our FY27/FY28 EPS estimates upwards by 2.4%/7.3% and arrive at our target price of INR 1,215. We value the company at 40x (maintained) on the average FY27/28E EPS and change our rating to REDUCE from ADD.

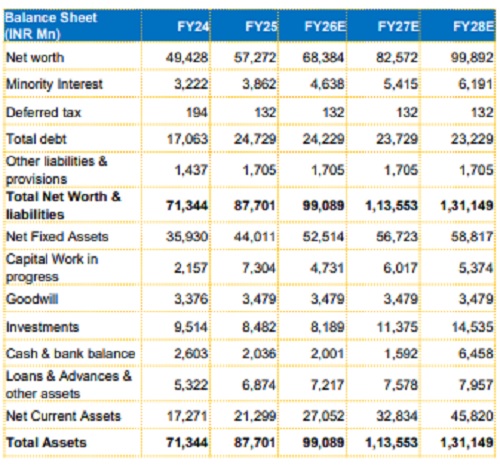

Financials:

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)