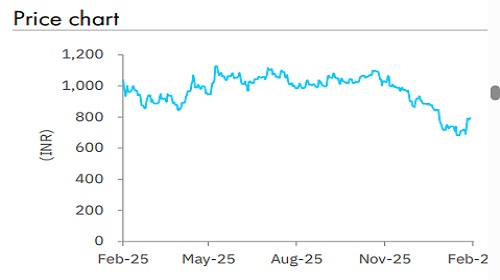

Accumulate Premier Energies Ltd for Target Rs 886 by Elara Capitals

Future-ready solar powerhouse

Premier Energies ( PREMIERE IN ) is a leading integrated solar manufacturer in India, spanning cells, modules, inverters, and transformers. It has ramped up module and cell production, embraced TOPCon technology , and is expanding into battery energy storage systems (BESS ) and alumin ium -frame production . A reliable domestic and internation supplier, it faces margin risk from rising competiti on . The stock has corrected 3 3% in the past from its peak, and current valuations bake in overcapacity concerns and margin compression. We initiate with an Accumulate rating with a TP of INR 8 86.

On track for full integration by FY28: A mong India’s largest solar equipment manufacturers, PREMIER E is p rimed to lead by FY28. This transition would be driven by: 1) scaling up its cell capacity from 3.2GW to 11.1GW &module capacity from 5.1GW to 10.6GW, and 2) adding 10GW each of ingot & wafer capacity . S trong process efficiency and backward integration secure its edge in the high realization domestic content requirement (DCR ) segment through FY28 , anchoring its competitive differentiation.

Module capacity to triple by FY26: The company’s manufacturing operations spans three Telangana -based subsidiaries — Premier Energies Photovoltaic (PEPPL), Premier Energies International (PEIPL) and Premier Energies Global Environment (PEGEPL). As on June 2025, these subsidiaries had capacit y of 1.4GW (PEPPL), 1.6GW (PEIPL) and 2.1GW (PEGEPL). A 6GW capacity expansion is underway , likely to be completed by March 2026. This new TOPCon module manufacturing line will be set up under PEGEPL.

Cell capacity to surge to 10GW by FY28: PREMIERE was among the first firm s to make solar cell s in India : its subsidiary PEPPL hit 0.5GW capacity by FY22. As on June 2025, total installed solar cell capacity increased to 3 .2GW, distributed across PEPPL (0.8GW), PEIPL (1.3GW), and PEGEPL (1.2GW).The company is executing a significant expansion p lan . About 1.2 GW of new cell capacity was commissioned in June 2025, while an additional 4.8GW is set to come online by FY27 and another 2.2 GW by FY28. By end -FY28, total cell manufacturing capacity is likely to reach 10 .0GW.

Initiate with Accumulate and a TP of INR 886: We e xpect a revenue CAGR of 35% and an EBITDA CAGR of 27% during FY25 -28E . We initiate coverage of PREMIERE with a n Accumulate rating and a TP of INR 886 based on 12x FY 28E EV/EBITDA . The stock has corrected 3 3% in the past from its peak of INR 1 ,177. Current valuation factors in oversupply concerns as well as margin pressure. Backward integrat ion fuels 2-3 years of robust expansion . Key risks include : 1) in creased competition from large domestic companies may erode pricing & margin , and 2) heavy US market reliance exposes it to policy, tariff s, and geopolitical uncertainty .

Please refer disclaimer at Report

SEBI Registration number is INH000000933