Buy Hero MotoCorp Ltd For the Target Rs. 5,099 by Choice Broking Ltd

HMCL reported an inline performance, with strong retail sales driven by a good festive season

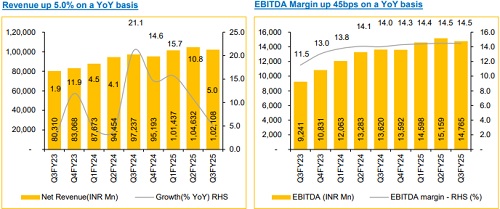

* Revenue for Q3FY25 was at INR 1,02,108 Mn up 5.0% YoY and down 2.4% QoQ (vs CEBPL est. at INR 1,00,785 Mn) led by 0.3% YoY growth in volume and 4.7% YoY growth in ASP.

* EBITDA for Q3FY25 was at INR 14,765 Mn, up 8.4% YoY and down 2.6% QoQ (vs CEBPL est. at INR 14,412 Mn). EBITDA margin was up 45 bps YoY and down 3bps QoQ to 14.5% (vs CEBPL est. at 14.3%).

* PAT for Q3FY25 was at INR 12,028 Mn, up 12.0% YoY and down 0.1% QoQ (vs CEBPL est. at INR 11,176 Mn).

Growing Market Share driven by improved rural demand:

HMCL expanded its retail market share by 520 basis points quarter-on-quarter reaching 32.8%, achieving its highest-ever retail sales in the quarter, exceeding 2 million units. HMCL saw a significant increase in rural demand during Q3, with its contribution increasing by almost 3%. We believe this increased rural demand will continue, aided by government initiatives announced in the Union Budget 2025 to boost the agriculture sector output and rural economy. HMCL, which gets a large part of its sales from the entry-level segment is set to benefit from these initiatives.

Focus on premiumisation to drive profitability:

EBITDA margin for the ICE business stood at 16% due to improvement in the premium product mix. HMCL has been actively launching new products in the premium segment which include the Xtreme 125R, XPulse 210 and Zoom 125 & Zoom 160 scooters. The company has been upgrading its stores to Hero 2.0 stores, with almost 700 such stores and Premia stores have also been expanded with over 60 stores. Being one of the four key growth pillars of the company, we believe the premium segment will continue to grow on the back of product launches, channel expansion and strategic investments.

View and Valuation:

We revise our FY26/27 EPS estimates downwards by 6.1%/7.1% and roll over our forecasts forward to come up with a revised target price of INR 5,099; valuing the company at 17x (previously 19x) on FY27E EPS while maintaining our ‘BUY' rating. We retain our positive view on HMCL driven by its focus on scaling up the premium product portfolio and a strong boost to rural demand.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131