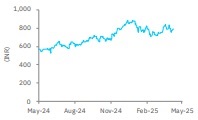

Accumulate Indian Hotels Company Ltd For Target Rs. 861 By Elara Capital

Growth momentum to continue

Indian Hotels Company (IH IN) reported higher-than-expected Q4, driven by 14% growth in average room rate (ARR) on strong domestic demand. Standalone occupancy grew 80bps YoY to 79.4% and management fee grew 15% to INR 1.7bn. Growth was driven by locations such as Delhi (27%), Mumbai (14%), Hyderabad (14%), Kolkata (26%), Bengaluru (28%), Chennai (12%), Rajasthan (12%) and Kerala (16%) as growth in demand outpaced supply. The management has guided for double-digit revenue growth in FY26 and beyond, with strong domestic demand (revenue in April up 17% with strong business on books in Q1), healthy ARR growth, higher number of wedding days, growth momentum in new businesses, three new owned hotels from IH in FY26 and opening of a new kitchen for TajSATS at Jewar airport in Noida. Size does not seem to be a cause of concern as IH continues to expand its reach despite being the leader, leveraging on its strong brand recall. Reiterate Accumulate with unchanged SoTPTP of INR 861, on 50x P/E to indicative FY27E EPS from management fee income, 25x EV/EBITDA to FY27E EBITDA of Taj SATS and EBITDA attributable to owned hotels.

IH to invest INR 1.2bn in capex in FY26: IH has guided for INR 12bn capex in FY26. Of this, 60–65% will be allocated towards major renovations and digital upgrades, while the remainder will go towards greenfield developments. Key renovation projects include Taj Palace (Delhi), Fort Aguada (Goa), Taj Bengal and the St. James (the UK). Among the greenfield and brownfield projects, IH expects completion of the 127-Key Vivanta, the 151-key Ginger at Ekta Nagar and the 100-key Taj Ganges (brownfield expansion) at Varanasi.

Better portfolio mix to drive management fee income in FY26-27: Management fee income grew 20% in FY25, and the number of managed hotel rooms rose 11%. IH has 15,900 keys in the managed hotel pipeline, of which 2,959 and 3,251 keys are likely to be opened in FY26E and FY27E, respectively. We expect accelerated growth in management fee to continue as new hotel openings from management contract in FY26 and FY27 are tilted towards highend brands such as Taj, SeleQtions and Vivanta. Fee per key from these three brands is significantly higher than fee per room from Ginger.

Reiterate Accumulate; TP at INR 861: Aggressive hotel signings pan-India through various brands, industry-leading financial performance and healthy investment plans underscore IH’s strategic intent to achieve “Accelerate 2030” target of doubling consolidated revenue, achieving industry-leading margin and generating 20% ROCE by 2030. Size does not seem to be a cause of concern as IH continues to expand its reach, leveraging on its strong brand recall.

We have reduced IH’s EBITDA estimates by 3% each for FY26E and FY27E to factor in lower margin for Taj SATS, to realign our RevPAR growth assumption. We reiterate Accumulate with SoTP-TP at INR 861 (unchanged), on 50x P/E to indicative FY27E EPS from management fee income and 25x EV/EBITDA to FY27E EBITDA of Taj SATS as well as EBITDA attributable to owned hotels.

Please refer disclaimer at Report

SEBI Registration number is INH000000933