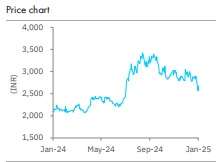

Accumulate Ajanta Pharma Ltd For Target Rs. 2,930 By Elara Capital Ltd

Minor misses

Ajanta Pharma’s (AJP IN) Q3FY25 revenue, EBITDA and PAT came in 8-11% below our estimates. Lumpiness in the Africa branded business and erosion in the anti-malarial tender business in Africa were the reasons for the miss. India business did well with growth at 12% YoY. Growth in the US business remained in low single-digit as guided earlier. EBITDA margin has stabilized at ~28%. Expect gradual improvement hereon. We lower our FY25E-27E core earnings estimates by 4-7%. So, we lower our TP from INR 3,209 to INR 2,930. With low-teen growth in the branded businesses and pick up in US business growth next year, AJP could remain a steady compounder – Retain Accumulate.

Lumpiness in branded business:

The branded business in Africa grew 12% YoY (in EURO), but was down 17-20% versus Q1 and Q2 levels. The management attributed this to the lumpiness associated with the complicated logistics involved in the distribution in that market. The underlying retail sales remain smooth. Asia branded business grew 11% YoY, broadly as expected. In the medium term, we expect growth to average to low double-digits in constant currency in both the businesses.

Political concerns over the malaria tender business:

Revenue from anti-malarial tender business in Africa declined 62% YoY to USD 4mn in Q3FY25. Uncertainties around the new political administration in the US have casted clouds over the funding for these procurement tenders. To that extent, the future of this business is uncertain.

Domestic business recovers; entering new segments:

The growth in the domestic business at 12% came in as expected, recovering from the low 8.7% growth in Q2. AJP outperformed the overall market. We continue to believe that AJP can grow faster than the market, led by its superior specialty portfolio. AJP has entered two new therapeutic segments – Gynaecology and Nephrology – in the domestic market, hiring ~200 sales representatives.

US to pick up in FY26:

US revenue was up ~3% YoY. The management has guided for pick-up in launch momentum and consequent growth pick-up in FY26. The launches in FY26 could include 2-3 limited competition products.

Retain Accumulate with a lower TP of INR 2,930:

We lower our FY25E-27E core earnings estimates by 4-7%. AJP trades at 33.2x FY26E core P/E. We lower our TP from INR 3,209 to INR 2,930, which is 33x FY27E core P/E plus cash per share – Retain Accumulate.

Geopolitical disruptions to the business and a spike in raw material and freight costs are key risks to our call. Continued muted growth in the domestic market could also be a risk.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)