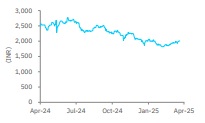

Accumulate ACC Ltd For Target Rs. 2,335 By Elara Capital

MSA supports volume

ACC’s (ACC IN) Q4FY25 EBITDA recovered ~69% QoQ to ~INR 8bn, on the back of better cement prices, higher volume, lower operating cost and a favorable base. However, it declined ~4% YoY, primarily hit by weak realization. Cash and cash equivalents stood at INR 35.9bn as of end-March 2025 versus ~INR 25.3bn as of end-December 2024 and ~INR 46.7bn as of endMarch 2024. Going ahead, we expect ACC to benefit from cement price hikes taken in the past few weeks and access to additional volume under master supply agreement (MSA). Also, ACC is likely to benefit from the tolling arrangement with the acquired assets in South India given its strong brand positioning there compared with Ambuja Cements (ACEM IN). Thus, we reiterate Accumulate with TP unchanged at INR 2,335, based on 11x FY27E EV/EBITDA

EBITDA/tonne down ~16% YoY but up ~53% QoQ: Sales volume grew ~14% YoY and ~11% QoQ to ~11.9mn tonnes, primarily supported by the ramp-up of the acquired assets under Adani Group, which ACC was able to access under MSA. While blended realization fell ~2% YoY, it improved ~3% QoQ to INR 5,052 per tonne, led by a rise in cement prices in most regions in Q4FY25, barring South India. Operating cost dipped ~2% QoQ but remained flat YoY to INR 4,379 per tonne. Freight cost declined ~8% YoY but remained flat QoQ, due to a fall in lead distance. Employee cost dropped ~7% YoY and ~20% QoQ, and other expenses also reduced by ~6% YoY and ~9% QoQ, benefiting from operating leverage. As a result, EBITDA per tonne fell ~16% YoY but surged ~53% QoQ to INR 673 versus our estimates of INR 720.

Cost saving measures continue: ACC’s waste heat recovery system (WHRS) power share increased from 8.2% in Q4FY24 to 13.5% in Q4FY25. Also, its solar power mix rose from 2.9% in Q4FY24 to 7.9% in Q4FY25, taking the green power share to 22.5%. The company reiterated its target to achieve 60% green power share by FY28. Further, its kiln fuel cost has fallen to INR 1.47/Kcal in Q4FY25 from INR 1.91/Kcal in Q4FY24, led by use of low-cost imported petcoke, improved linkage and captive coal consumption and synergies with group companies.

Reiterate Accumulate, TP unchanged at INR 2,335: We expect ACC’s volume growth to remain healthy in the coming quarters as well, driven by better demand, likely completion of ongoing growth projects, and continued access to incremental volume under MSA.

On an EV/tonne basis, the stock is trading below its historical average and closer to greenfield capex cost. Therefore, we largely retain our EBITDA estimates for FY26E-27E and introduce FY28E. We reiterate Accumulate with TP unchanged at INR 2,335, based on 11x (unchanged) FY27E EV/EBITDA. Sub-par demand, weak cement price and a sharp rise in fuel price are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933