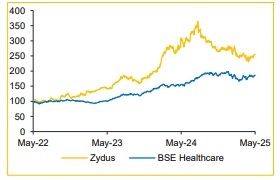

Sell Zydus Lifesciences Ltd For Target Rs. 795 - Choice Broking Ltd

US Slowdown and Margin Pressure Warrant Caution

We believe the outlook for FY26 for the company will be challenging. Management has guided for single-digit growth in the US formulations segment— a significant slowdown considering its substantial contribution to overall revenue. This, coupled with an expected 400 bps contraction in EBITDA margins, is likely to impact overall profitability.

Despite steady momentum expected in India Formulations + Consumer Wellness, and International Markets, the headwinds in the US market and margin pressures lead us to revise our FY26E/FY27E earnings estimates downward by 15.3%/11.8%, respectively. We now assign a PE multiple of 15x to FY27E EPS (revised from 17x), reflecting a reset in expectations driven by earnings downgrades and margin compression. The reduction in ROE and ROCE, stemming from the deterioration in profitability, further justifies the valuation derating. Accordingly, we revise our target price to INR 795 (from INR 1,240 in Q3FY25) and downgrade our rating to SELL.

Upside risk to our thesis includes successful high-margin product launches in the US that may cushion earnings against Revlimid tapering.

Strong Operational Performance; PAT Miss on One-Off Impact

* Revenue grew 18.0% YoY / 23.9% QoQ to INR 65.3 Bn (vs. consensus estimate: INR 64.4 Bn).

* EBITDA increased 30.4% YoY / 53.2% QoQ to INR 21.3 Bn (vs. consensus: INR 20.3 Bn); margins expanded 310 bps YoY / 623 bps QoQ to 32.6% (vs. consensus: 31.4%).

* PAT declined 0.7% YoY / 14.4% QoQ to INR 11.7 Bn (in line with consensus estimate: INR 11.7 Bn).

* Exceptional items of INR 2.2 Bn pertain to goodwill impairment in the Brazil business; adjusting for this, PAT stood at INR 13.3 Bn.

US Growth to Slow Amid Revlimid Taper and Mirabegron Litigation: Zyuds’ US formulations segment grew 27.2% YoY in FY25, now accounting for 47.5% of total revenue. However, this strong performance is unlikely to sustain in FY26. Management expects growth to moderate to single digits as Revlimid contributions begin tapering, with FY25 marking the drug’s peak sales. The upcoming patent expiry in Jan 2026, persistent pricing pressures, and uncertainty around the Mirabegron litigation further add to near-term headwinds.

Margins to Compress Sharply on Product Mix and R&D Spend: EBITDA margins expanded by 290 bps YoY to 30.4% in FY25, supported by product mix and cost optimization. However, management has guided for a 400 bps contraction in FY26, bringing margins closer to ~26%. This decline is attributed to the lower contribution from high-margin products like Revlimid, market share loss in Asacol, and an increase in R&D spending—expected to rise to ~8% of revenue.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)