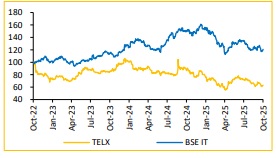

Sell Tata Elxsi Ltd for the Target Rs.4,120 by Choice Broking Ltd

In-Line Q2 Performance; H2FY26 Growth Visibility Improves

TELX reported an in-line performance for Q2FY26 with modest sequential recovery and early signs of operational stabilisation. While near-term challenges persist in Automotive and Media & Communications, H2FY26 growth visibility has improved on the back of large Transportation deal ramp-ups and a strong Healthcare pipeline. Margins are expected to recover gradually with higher utilization and operational efficiencies. We maintain our PE multiple at 28x, arriving at a Target Price of INR 4,120 based on average FY27E–FY28E EPS of 147.3. We reiterate our SELL rating, while noting that sustained doubledigit growth momentum in the Transportation & HLS vertical, margin expansion, and improved deal wins in Media & Communications could act as potential re-rating triggers.

Q2FY26 Revenue & PAT in-line; EBITM Modestly above our Estimates

* Revenue for Q2FY26 came in at INR 9.1Bn, up 1.0% QoQ but down 8.3% YoY in CC. In INR terms, revenue rose 2.9% QoQ but declined 3.9% YoY (vs CIE est. at INR 9.1Bn).

* EBIT for Q2FY26 came in at INR 1.7Bn, up 4.6% QoQ but down 29.0% YoY (vs CIE est. at INR 1.6Bn). EBIT margin was up 29bps QoQ but down 655bps YoY to 18.5% (vs CIE est. at 18.1%).

* PAT for Q2FY26 stood at INR 1.5Bn, up 7.2% QoQ but down 32.5% YoY (vs CIE est. at INR 1.5Bn).

Muted Quarter; Revenue Growth Driven by Transportation & HLS: TELX reported a soft Q2FY26, with sequential revenue growth of 1.0% in CC, marking a modest recovery after 2 consecutive quarters of decline. Growth was led by Media & Communications segment (+4% QoQ), partially offset by moderate gains in Transportation and a 4.5% QoQ decline in Healthcare and Lifescience (HLS). Transportation was impacted by the deferment of a JLR program due to cybersecurity concerns, though traction across other SDV programs, global OEMs, and Aerospace & Defence sub-segments supports expectations of double-digit growth in FY27E. HLS de-growth reflects completed regulatory programs, but a strong pipeline underpins similar FY27E growth expectations. Media & Communications remains subdued amid industry restructuring, though selective deal ramp-ups provide limited near-term support. We believe near-term growth remains moderate, with H2FY26 expected to post stronger sequential performance, led by large-deal ramp-ups and improvement in utilization.

Sequential Margin Recovery, Utilization Levers to Drive FY27E Growth: TELX reported EBITM of 18.5% in Q2FY26, up 30bps QoQ, aided by favourable currency movement and higher utilization, partially offset by increased people and AI infrastructure costs. Utilization improved to 70% (vs. 66% in Q1), with management targeting 75% by FY26-end, supporting gradual margin recovery despite upcoming Q3 wage hike. We expect FY26 EBITM to stabilise at 18.9% (vs. 23.3% in FY25), with a return to the 22–23% band in FY27E dependent on sustained revenue growth and operational execution. We maintain a constructive medium-term view, given the company’s strong cost discipline, improving utilization trajectory and leverage potential from large deal rampups in Transportation and Healthcare

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)