Renewables Sector Report : Integrated Leaders Thrive Amid Overcapacity

India’s solar module capacity has surged , sparking overcapacity concerns as production outpaces installation and exports s tall . The Central Electricity Authority (CEA) expects s olar capacity to expand to 364GW by FY32 from 1 36GW currently , fuelled by supportive policies and renewable energy (RE) targets. Vertically integrated manufacturers stand out, leveraging backward integration for superior supply chain control. We initiat e coverage on four key renewable s equipment ma kers – Waaree Energies (WAAREEEN IN) , Premier Energies (PREMIERE IN) with Accumulate rating s; Vikram Solar (VIKRAMSO IN ) and Emmvee Photovoltaic Power (EMMVEE IN) with Buy rating s. WAAREEEN and PREMIERE have corrected 33% and 40%, respectively , from peaks . Current valuations factor in oversupply and margin risks ; however, the se firms ’ integration w ould drive sustain ed high growth for the next 2 -3 years. VIKRAMSO and EMMVEE trad e at 35 -40% discount to WAAREE EN and PREMIERE .

Overcapacity risk from supply–demand mismatch in solar module: India’s solar manufacturing ecosystem has scaled rapidly , with module capacity hitting ~144GW (operational) and projected a t ~180GW by FY30 ; cells stood at ~2 3.4GW (Source: MNRE ). A nnual solar installations may reach a mere 45– 50 GW v s module output of 60 – 65GW , creating overcapacity situation . US tariffs have cur bed exports, f looding the domestic market and adding pressure on smaller and pure -play module producer s toward consolidation .

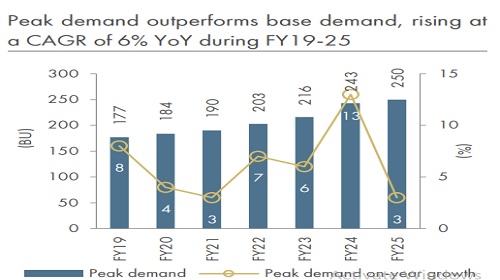

Tailwinds persists with ambitious RE goals: India targets 500GW RE capacity by CY30 . Within a total power mix of 514GW, RE contribut es 49% (Source: Central Electricity Authority ). Solar leads at 136GW, registering a CAGR of 3 9% during FY14 -26 YTD vs wind’s 8% during the same period. Momentum builds via policy support , increased adoption of solar -plus -battery projects , and government initiatives , pushing solar capacity to 364GW by FY32

Vertically integrated leaders gain supply chain edge: Oversupply in module outstrips near -term demand , pivoting India’s solar module industry, from rapid capacity addition to backward integration and manufacturing maturity, as upstream segments , such as cells, wafers, ingots, and polysilicon , remain relatively underdeveloped. The ALMM List -II (cells from Jun e 20 26) and mandates for domestic cell s will spike demand for local cells . Manufacturers that build and stabilize largescale cell capacity ahead of peer s, potentially before FY28 – such as under coverage companies like WAAREEEN , PREMIERE , VIKRAMSO , and EMMVEE -- hold a significant advantage . A ll four companies are pursuing aggressive capacity expansion and backward integration during FY25 -28E , boasting strong orderbooks and differentiated growth drivers in India’s solar manufacturing vanguard .

Above views are of the author and not of the website kindly read disclaimer