RBI MPC Preview : Policy tone will be key monitorable By JM Financial Service

The MPC will be deliberating on how to complement the fiscal measures with its policy decision to boost consumption in the economy through effective transmission. RBI’s tone will be key monitorable in this meeting, as a dovish tone will ensure effective transmission through the bond channel. Rationalisation in GST will aid headline inflation however the trajectory will continue to be upward sloping. We expect RBI to lower its inflation expectation below the 3% mark for FY26, while a dovish tone will call for an unchanged growth projection. Yields hardened (6bps) despite lower allocation in the longer end in the government’s 2HFY26 borrowing calender; a hawkish tone at this stage will harden yields further. Although we believe that a rate cut will be appropriate at this stage, communication will be a key monitorable irrespective of whether RBI goes in for a rate cut or maintains status quo.

* Markets expect a dovish tone: The Reserve Bank of India’s monetary policy committee (MPC) will be meeting against the backdrop of the elevated tariffs (50%) imposed by the US even as there is lingering uncertainty over the finalisation of a bilateral trade deal. The impact of the fiscal measures (Tax exemption + GST rationalisation) and front-loaded policy easing in the domestic economy is working its way through the economy; a carefully planned policy move by the RBI will aid consumption if the transmission is effective. Whether the RBI delivers a rate cut or maintains status quo, it should be accompanied with a dovish tone.

* Lower inflation; growth unchanged: We expect the RBI to lower its inflation projections for 4QFY26 to 4% while the annual projection is expected to fall below 3% mark in FY26. Our assessment of the impact of GST rationalisation reveals that the GST liability on the CPI basket will ease to ~7% vs. 11.9% earlier, lowering cost by ~5% (Ex 13). We believe that although GST rationalisation will aid headline inflation, depending on the timing and the extent of pass-through, the trajectory will continue to be upward sloping. We think that the RBI will have to maintain a dovish tone to keep yields in check, hence growth projections are likely to be unchanged at 6.5% for FY26. RBI’s commentary and its tone will be a key monitorable in this meeting; a dovish tone will deliver the desired outcome of transmission through the bond chanel.

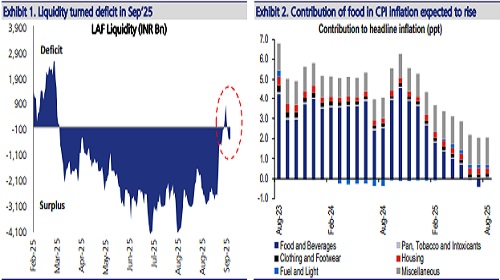

* Call rates in check; yields elevated: System liquidity reverted to surplus territory (INR 470bn) after briefly turning deficit (INR 870bn) last week. Call rates (5.4%) have been trading within the policy corridor, reflecting the effectiveness of the RBI’s liquidity management through VRRRs till now. Even as the money market rates behaved well, elevated G-sec yields did disrupt the borrowing plans of states and NBFCs recently. Taking note of the demand and supply dynamics, the Centre reduced its share of borrowing at the longer end (30-50 yr) from 35% in 1HFY26 to 29.5% in 2HFY26 (Ex 12). Despite this change, benchmark (10yr) yields hardened by ~ 6bps to 6.55%. It was observed that despite the front-loading of rate cuts in June, the transmission through the bond chanel was not effective – as yields hardened ~40bps but later softened ~10bps. The yield curve shifted upwards at the longer end after the policy meeting in Aug’25.

* Dovish tone for effective transmission: The call that the MPC needs to take in the upcoming meeting is how to complement fiscal policy measures to boost consumption in the economy through effective transmission. RBI’s policy tone will be monitored closely by the bond markets, irrespective of whether it delivers a rate cut or maintains status quo. We believe that a rate cut at this stage will be more appropriate considering that monetary policy works with a lag. Our earlier assessment of a limited window for policy easing due to the upward sloping inflation trajectory holds true; however, that limited window gets extended due to the positive impact of GST. Hence a status quo in October can be followed by a rate cut in Dec’25. But a hawkish tone at this stage will be detrimental and will reflect in further hardening of yields.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)