Neutral KFin Technologies Ltd for the Target Rs.1,110 by Motilal Oswal Financial Services Ltd

Strong growth in international business

* KFin Technologies (KFin) reported 28% YoY growth in operating revenue to INR3.7b in 3QFY26 (15% beat), aided by the integration of Ascent from this quarter, which contributed incremental revenue of INR478.3m. Excluding Ascent’s contribution, revenue was in line. For 9 MFY26, revenue grew 18% YoY to INR9.5b.

* Total operating expenses grew 37% YoY to INR2.2b (21% higher than est. owing to the Ascent integration), with employee expenses growing 42% YoY to INR1.5b and other expenses growing 29% YoY to INR716m. The cost-to-income ratio was 59.1% (vs. 55% in 3QFY25).

* EBITDA grew 16% YoY to INR1.5b with EBITDA margins at 40.9% vs. 45% in 3QFY25 (MOFSLe of 44%). While Ascent had an incremental contribution to revenue, its contribution to profitability was not material, which impacted EBITDA margin.

* KFin reported a net profit of INR920m, up 2% YoY (7% miss) in 3QFY26, with PAT margin of 24.8% vs. 31.1% in 3QFY25. Excluding the impact of the labor code of ~INR86m, PAT was in line. For 9MFY26, KFIN reported PAT of INR2.6b, up 6% YoY.

* MF revenue share declined to 59.8% in 3Q (vs. ~71% in 3QFY25), driven by the Ascent acquisition, which lifted international contribution to 16.7% (vs. ~4% YoY). This supports the strategy to lower domestic MF concentration (<50%) and reduce market dependency to ~55% through global/private market diversification.

* We have largely maintained our earnings estimates, incorporating the impact of the Ascent acquisition. We expect KFin’s revenue, EBITDA, and PAT to deliver a CAGR of 20%/19%/20% over FY26-28E. We reiterate our Neutral rating on the stock, with a one-year TP of INR1,110, based on a 35x P/E multiple applied to FY28E earnings.

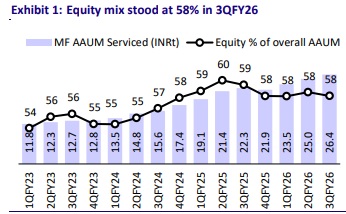

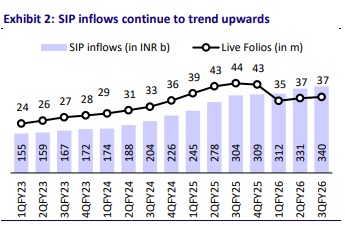

Equity AAUM share declines sequentially

* KFin’s total MF AAUM serviced during the quarter rose 18% YoY to INR26.4t. Equity AAUM, at 58% of total MF AAUM, grew 15% YoY to INR15.3t, reflecting a market share of 32.7% (33.4% in 3QFY25).

* Strong net flows and stable market share were partly offset by a yield moderation to 3.4bp in 3QFY26 (vs 3.7bp YoY), driving 8% YoY growth in domestic MF revenue to INR2.2b (in line). The segment contributed 59.8% to total revenue (vs ~71% in 3QFY25).

* The company won two new RTA mandates and two SIF mandates during the quarter under the MF segment.

* In issuer services, mainboard IPO market share (issue size basis) declined to 43.4% in 3QFY26 (vs. 66.4% in 3QFY25; 43.8% in 2QFY26) due to fewer IPOs handled (11 vs 14 in 3QFY25). Revenue grew 24% YoY to INR543m, with segment contribution stable at 15% of total revenue.

* In international investor solutions, revenue (ex-Ascent) grew 17% YoY/3% QoQ to INR441.8m; including Ascent, revenue surged 143.3% YoY/114.1% QoQ, raising segment contribution to 16.7% (vs. 3.8% in 3QFY25; 4.6% in 2QFY26)

* In the alternates and wealth business, KFin’s market share stood at 39% vs. 36.7% in 3QFY25, with AUM of INR1.8t. NPS market share continues to rise at 11.2% in 3QFY26 (9.4% in 3QFY25), with AUM of INR638.9b.

* The non-domestic mutual fund revenue contributed ~40% to total revenue vs. 29% in 3QFY25. The value-added services contributed ~6.8% to its revenue vs. 7.8% in 3QFY25/9.3% in 2QFY26.

* Other income declined 27% YoY/38% QoQ to INR66m (vs. our estimates of INR115m).

Key takeaways from the management commentary

* Consolidated EBITDA margin (incl. Ascent) stood at 40.9%, moderating ~300bp QoQ due to integration costs and amortization (within guidance).Margins are expected to remain range-bound at 40-45%.

* Under the issuer solutions, per-folio realization improved to INR12.9 (vs. INR11.2 in 3QFY25), driven by relatively lower retail participation.Management expects normalization ahead.

* Ascent margins remained below KFin’s core levels; management targets convergence within three years via scale and cost optimization, with potential to surpass domestic margins over the long term.

Valuation and view

* Structural tailwinds in the MF industry are expected to drive absolute growth in KFin’s MF revenue. With its differentiated ‘platform-as-a-service’ model offering, technology-driven, asset-light model, growing contribution from nonMF segments, and integration of global fund administration capabilities through Ascent, KFin is well-positioned to capitalize on strong growth opportunities in both Indian and global markets.

* We have largely maintained our earnings estimates, incorporating the impact of the Ascent acquisition. We expect KFin’s revenue, EBITDA, and PAT to deliver a CAGR of 20%/19%/20%, over FY26-28E. We reiterate our Neutral rating on the stock, with a one-year TP of INR1,110, based on a 35x P/E multiple applied to FY28E earnings.3

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

2.jpg)