Neutral Colgate Ltd for the Target Rs. 2,550by Motilal Oswal Financial Services Ltd

Ltd ( 1 ).jpg)

All-round weak performance

* Colgate’s (CLGT) 1QFY26 performance remained weak as its revenue fell 4% YoY to INR14.3b (miss), affected by a low-single-digit volume decline in toothpaste (est. +1.5%). The demand environment remained challenging amid soft urban demand and elevated competitive intensity. For CLGT, rural markets continued to outperform urban markets. CLGT continued to focus on premiumization and investing in its brands, resulting in the premium portfolio delivering better revenue growth.

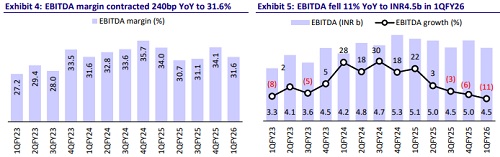

* Gross margin contracted 170bp both YoY and QoQ to 68.9% (est. 71.0%). EBITDA margin contracted 240bp YoY and 250bp QoQ to 31.6% (est. 32.6%). EBITDA declined by 11% YoY to INR4.5b.

* In line with CLGT’s strategic focus, product innovations and marketing efforts continued during the quarter. It will be important to monitor the volume growth trajectory going ahead as the company expects a gradual recovery 2HFY26 onwards.

* 1Q was a weak quarter for CLGT, and its near-term commentary remains muted. The company expects a gradual recovery from 2HFY26 onward. We model a 7% revenue CAGR over FY26-28E and steady EBITDA margins at ~33%. The current valuations at 46x/42x P/E on FY26E/FY27E capture most of the near-term triggers. We reiterate our Neutral rating on the stock with a TP of INR2,550 (based on 45x Jun’27E EPS).

Miss across parameters

* Volumes declined in low-single digit: Sales declined 4% YoY to INR14.3b (est. INR15.2b) on a high base of 13% growth, soft urban demand and elevated competitive intensity. CLGT has been facing high competition from the top players in toothpaste. Toothbrush performance was still relatively resilient.

* Miss on margins: Gross margins contracted by 170bp both YoY and QoQ to 68.9% (est. 71%). Gross profit fell 6.5% YoY. In operating costs, employee expenses rose 5% YoY, whereas ad-spends and other expenses were down by 5% and 4%, respectively. EBITDA margin contracted by ~240bp YoY and 250bp QoQ to 31.6% (est. 32.6%).

* Decline in profitability: EBITDA declined 11% YoY to INR4.5b (est. INR4.9b). PBT fell 12% YoY to INR4.3b (est. INR4.7b). APAT was down 12% YoY at INR3.2b (est. INR3.5b).

Key highlights from management commentary

* CLGT continued to focus on premiumization, resulting in the premium portfolio delivering better revenue growth.

* Toothbrush performance was still relatively resilient compared to toothpaste.

* The company continued to invest in brands, in line with its strategy.

* It has introduced Colgate Kids Squeezy Toothpaste in Strawberry and Watermelon flavors for children aged 3-6. Its easy-to-squeeze bottle and fun grip are ideal for small hands.

* CLGT has also launched MaxFresh Mouthwash Sachet Stick in fresh tea flavor, catering to on-the-go freshness needs.

* The company expects a gradual recovery 2HFY26 onwards.

Valuation and view

* Given the weaker-than-expected performance in 1QFY26, we cut our EPS estimates for FY26/FY27 by 7%/6%.

* Over the last couple of quarters, CLGT has reported subdued volume growth, as seen in its historical trends, barring the improvement seen in 2-3 quarters of FY25. Given the continued softness in urban demand, monitoring the volume trajectory will be key in the upcoming quarters.

* Moreover, we believe that it will be challenging for CLGT to sustain the current high operating margins amid rising competitive intensity and increasing promotional spending.

* We reiterate our Neutral rating on the stock with a TP of INR2,550 (based on 45x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412