Monthly Update : Cement - GST benefits passed on; prices steady By Prabhudas Lilladher Pvt Ltd

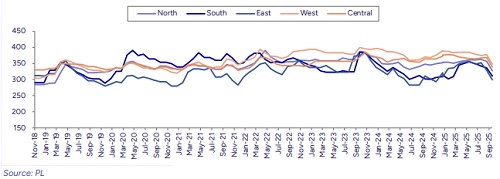

We interacted with cement dealers across regions in India to assess demand and pricing trends in Sep’25. Our discussions indicate that demand remained weak across most markets, impacted by rains, labor shortages, and ongoing festive activities. Prices largely reflect GST-related adjustments, with companies passing on the full benefits to customers. The Western and Central regions saw stable markets, while the Eastern region remained subdued with limited offtake due to intense weather. In the Southern region, demand showed gradual recovery in Chennai, whereas Hyderabad continued to witness weak offtake. Northern markets saw some improvement recently, but overall demand is expected to pick up meaningfully only post Diwali. The all-India average selling price declined by Rs29 MoM to ~Rs325/bag. Going forward, dealers across regions expect a meaningful recovery only after Diwali.

Cement prices are unlikely to rise in the near term due to government restrictions ensuring GST benefits are passed on to customers. This could weigh on the industry during the seasonally strong quarter, leading to lowerthan-expected realizations in Q3 and, consequently, reduced EBITDA per ton. Elevated input costs, such as pet coke (up 8% QoQ to USD120/t) and gypsum, could further pressure near term margins. However, the early conclusion of the festive season, coupled with an expected increase in consumption, may support volume growth and partially offset the margin impact. Accumulate UTCEM & ACEM at lower levels.

Northern Region

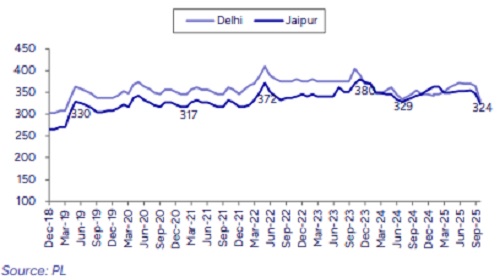

In Delhi, cement prices have corrected by about Rs.25-30/bag following the GST rate rationalisation. Companies are fully passing on the benefits to customers. Demand remained slow through September due to rains and worker unavailability, though some improvement has been seen post-Shradh and following the implementation of the new GST rates. Dealers do not expect any price hikes in the near term and believe meaningful demand revival will only take place after Diwali.

In Jaipur, dealers highlighted that companies fully passing on GST-related reductions to the customers. Demand this month was impacted as farmers remain occupied with harvesting crops such as jowar, bajra, and groundnut, though recovery has been visible post GST implementation and as rains subsided. Dealers expect demand to remain decent until Diwali, with only a temporary festive slowdown, and anticipate further improvement thereafter. However, they do not foresee any price hikes for the next 2–3 months, as government intervention is likely to prevent near-term increases. Overall, sentiment has turned positive with expectations of better demand ahead.

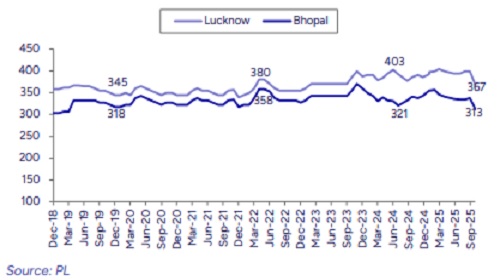

Exhibit 2: GST benefit of ~Rs29/bag fully passed on in the North

Southern region

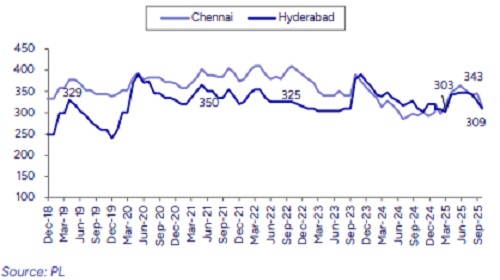

In Chennai, cement demand is currently stable to moderate, with dealers anticipating a pickup from October onwards. They expect upcoming electionrelated spending to support infrastructure and construction activity in the state, thereby boosting consumption. The ~Rs.30/bag price reduction following the GST cut has largely been absorbed, and dealers believe prices are unlikely to move higher until a few months of sustained demand recovery are seen.

In Hyderabad, cement demand remained severely weak through September, with dealers attributing the slowdown to persistent rains and festive disruptions. Construction activity across the city and surrounding areas has been minimal, resulting in significantly lower offtake compared to normal seasonal levels. Demand, which was already average in late August, deteriorated further in September with no visible improvement during the month. Dealers expect a gradual recovery only after Dussehra, once rains ease and construction activity resumes.

Exhibit 3: Hyderabad only passed on Rs19/bag due to higher older inventory

Eastern region

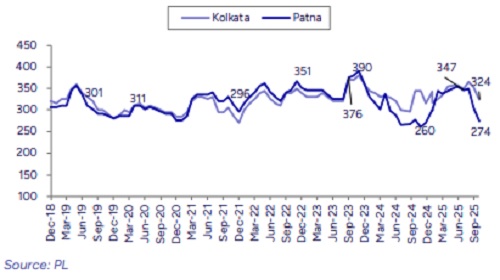

Cement demand in Kolkata has been subdued due to heavy rains, floods, and restrictions due to Durga Puja preparations. As per the dealers, buyers deferred their purchases in anticipation of lower prices following the GST 2.0 cut, which reduced GST on cement by 10%. While one of the dealers mentioned a Rs10/bag hike, which did not sustain, and current prices largely reflect the GST-related reduction. Overall demand remains weak but is expected to improve once festive season ends and the market stabilizes post-GST clarity.

Exhibit 4: Firm prices in East despite intense weather; full GST passed on

In Patna, cement demand remains subdued due to the monsoon and ongoing festive season. However, dealers expect gradual improvement, supported by GST rationalization, with a potential price hike likely towards the end of Q3 (December) as demand strengthens. They highlighted that the revised post-GST prices are still being integrated into the system—while some dealers have adopted the new rates, others remain uncertain and continue to sell small quantities at the older prices.

Cement demand in Ranchi is very weak at around 30-40% of actual normal demand, with dealers attributing the slowdown to ongoing festive preparations. Prices have been adjusted in line with the GST revision, and the benefits are being fully passed on. Apart from the GST-related reduction, there have been no further price changes, and overall demand remains muted.

Western region

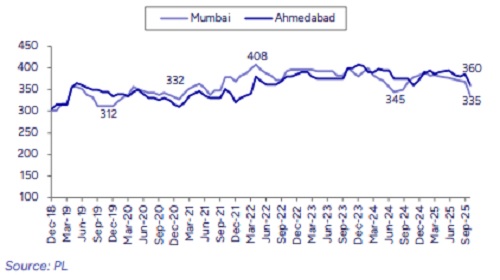

In Mumbai, cement prices have remained unchanged apart from the GST-related cut, with companies fully passing on the benefits to customers. Demand has been weak, impacted by uneven rains that disrupted infra projects and slowed activity in the real estate sector. With Navratri and Diwali adding to the seasonal lull, demand is expected to stay sluggish until the festive season concludes, with a meaningful recovery afterwards. No price hikes are anticipated in the near term.

In Ahmedabad, cement demand remained weak in September as buyers deferred purchases following the GST cut. Prices were stable compared to August, apart from the GST-related reduction. With festive season contributing to a temporary slowdown, dealers expect demand to recover only from mid-October onwards.

Exhibit 5: Prices remained flat despite rains; full GST passed on

Central region

Lucknow dealers have indicated ~Rs.30/bag reduction from the GST rate cut, with companies fully passing on the benefits to customers. Demand was impacted through September due to persistent rains and labor unavailability, though a slight recovery was seen post GST implementation. Dealers expect full demand revival only post Diwali, once construction activity picks up pace. They do not anticipate any price hikes in the near term, with companies likely to maintain current pricing for the next few months.

Exhibit 5: Passing on full GST benefits to the customers in the Central region

In Bhopal, dealers indicated that companies are largely passing on the full GST benefits, with billing prices reduced accordingly. Demand was weak through September as many buyers delayed work in anticipation of GST implementation, while rains and labor shortages (with workers engaged in harvesting Rabi crops) further impacted activity. Since GST came into effect, demand has recovered and piled-up inventory has cleared up, leading to healthy sales. Dealers expect demand to remain decent through the first half of October, though activity may soften temporarily as laborers return home for festivals. A meaningful recovery is anticipated in November once the festive season concludes, with dealers expecting demand to be much stronger compared to recent months.

Exhibit 5: All-India average selling price declined by Rs29/bag led by implementation of GST; flat realizations MoM

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

Internet Sector Update : Amazon expands Now to Mumbai; 100+ stores operational across 3 citi...