MCX Natural gas November future is expected to slip towards Rs 330, as long as it stays under Rs 350 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to face hurdle near $4000 per ounce and move lower towards $3890 amid strong dollar and rise in US treasury yields. Hawkish comments from the US Fed chair have lowered the probability of December rate cut to 67% from 90% a day ago. Additionally, no rate cut from the ECB and BOJ might bring a check on the upside in bullions prices. At the same time, optimism over US-China trade deal and outflow from gold backed ETFs likely to restrict upside in prices.

• Spot gold is likely to face strong resistance near $4000 and move towards $3890. Only move below $3890 it would turn weaker towards $3800. Formation of trend reversal pattern in daily charts indicates more correction in the yellow metal. MCX Gold December is expected to face resistance near Rs 121,400 level and move back towards Rs 117,800 level.

• MCX Silver Dec is expected to hold the key support at Rs 145,000 level and move higher towards Rs 148,000 level.

Base Metal Outlook

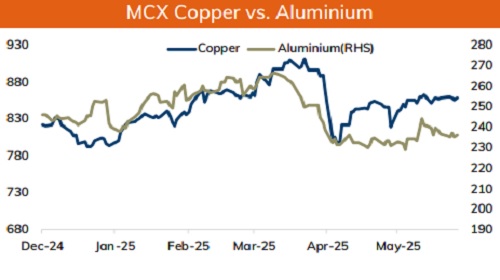

• Copper prices are expected to take a pause in its rally amid strong dollar. Further, hawkish Fed comments and minishing prospects of December rate cut would restrict its up move. Meanwhile, optimism over US-China trade deal and supply concerns would provide support to prices. Additionally, depleting inventory levels in LME and expectation of fresh round of stimulus from China would support the metal

• MCX Copper November is expected to slip towards Rs 1010, as long as it stays under Rs 1026 level.

• MCX Aluminum November is expected to move in the band of Rs 269 and Rs 274 level. Only below Rs 269, it would turn weaker towards Rs 266.

• MCX Zinc November looks to rise towards Rs 304 as long as it holds key support at Rs 299. Depleting inventory levels in LME would likely to support prices. Further, a new free trade agreement between ASEANChina would boost investor sentiments.

Energy Outlook

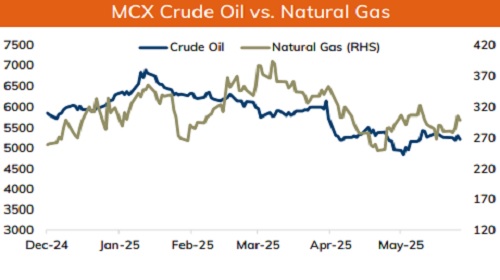

• NYMEX Crude oil expected to hold support near $60 per barrel and move towards $62 over the optimism on US-China trade deal. Further, depleting US crude oil inventories and improved risk sentiments would also support oil prices to regain its strength. Meanwhile, growing prospects of higher OPEC+ supply in its upcoming meeting would restrict any major upside in prices. OPEC+ is expected to increase the oil output by 137,000 barrels per day in December.

• On the data front, a strong put base at $60 strike indicates NYMEX crude to hold strong support. On the upside $65 call strike has higher OI concentration which may act as key hurdle. MCX Crude oil November is likely to find support near Rs 5250 and rebound towards Rs 5400. Only below Rs 5250 it would turn weaker towards Rs 5150,

• MCX Natural gas November future is expected to slip towards Rs 330, as long as it stays under Rs 350 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631