Turmeric Report 18th December 2025 by Amit Gupta, Kedia Advisory

India’s turmeric crop for 2026 is up in acreage (+15–20%) but yields in Maharashtra were impacted by unseasonal rainfall. Dried turmeric production estimated at ~90-92 lakh bags, bringing total availability to ~105 lakh bags. Quality concerns in low-lying areas may create premium for select lots. Telangana, Andhra Pradesh, and Tamil Nadu report healthy crops. IPM output (~1,700–1,800 MT) meets EU standards, supporting export potential. Global supply outside India remains stable, keeping India as the price leader. Overall, prices are likely to remain firm with mild upward bias.

Key Highlights

* Moderate supply increase (~8.5%) suggests limited price pressure despite higher acreage.

* Quality issues in Maharashtra (rot/aflatoxin) may boost premiums for better lots.

* IPM-certified EU-standard output supports export demand, likely sustaining prices.

* Strong regional crops in Andhra Pradesh, Telangana, Tamil Nadu balance moderate losses elsewhere.

* Global supply remains stable; Indian market continues as key price determinant.

Overall Crop Situation

Turmeric acreage for the 2026 harvest in India is higher than last year, but localized weather and disease risks may restrict production, keeping the crop near normal levels rather than exceptional.

India: Crop and Weather Outlook (2025–26 Season)

* Estimated acreage: 3.02 lakh hectares (+4% YoY from 2.91 lakh hectares)

* Fresh turmeric production: 11.41 lakh tonnes

Maharashtra (Sangli, Nanded, Hingoli, etc.)

* Expected dried turmeric production: ~50 lakh bags (vs 47.5 lakh bags last season)

* Weather impact: Heavy/unseasonal rainfall in Aug–Sep caused waterlogging and diseases; ~15% of Nanded area damaged.

* Net impact: Despite a 10–15% yield reduction, overall production is 15-20% higher YoY. Quality concerns include rhizome rot and aflatoxin risk in poorly drained fields.

Telangana, Andhra Pradesh, Tamil Nadu, and Other States

* Expected dried turmeric production: ~40 lakh bags (vs 35 lakh bags last season)

* Acreage: ~15% higher YoY

* Regional highlights:

* Andhra Pradesh & Telangana: Improved crop prospects after last year’s yield recovery.

* Tamil Nadu: Mostly irrigated; stable-to-higher crop with good quality (Erode–Salem).

* Odisha, West Bengal, Madhya Pradesh, North-East, Gujarat: Stable acreage; normal monsoon.

India Summary – 2026 Harvest

* Acreage: +15–20% YoY

* Yield: Slightly lower in parts of Maharashtra due to unseasonal rains

* Total dried turmeric production: ~90 lakh bags (vs 82 lakh bags last season)

* Carry-forward stock: ~15 lakh bags (vs 20.75 lakh bags last season)

* Overall availability: ~105 lakh bags (~6.16 lakh MT, 55-kg bags) vs 103.25 lakh bags (~5.68 lakh MT) last year.

IPM Production in India

* IPM areas in Maharashtra, Andhra Pradesh, and Tamil Nadu are gradually increasing.

* Expected 7–8% of the 2026 crop to be IPM-certified.

* Approx. 1,700–1,800 MT from Sangli and Marathwada likely to meet EU norms.

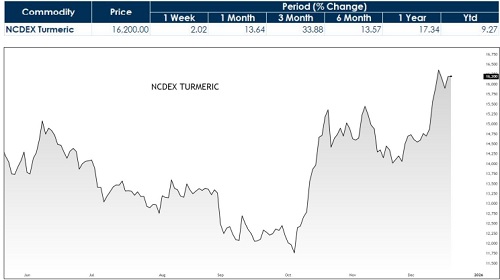

Technicals

Looking at the Daily chart of Turmeric Futures on NCDEX, the market is showing a clear recovery after a prolonged consolidation phase. Prices are trading above 16200, forming a well-defined rounding bottom pattern, which usually signals a gradual shift from selling pressure to buying interest. Momentum indicators are supportive, though volatility remains slightly elevated, suggesting active participation from traders.

RSI is currently hovering near 60, which points to healthy positive momentum without entering overbought territory. What’s interesting here is that RSI is making higher lows, indicating improving strength. MACD remains in positive territory, with the signal line above zero and the histogram gradually expanding, suggesting that upward momentum is building rather than fading. Volume has picked up during recent up-moves, which confirms that buyers are supporting the price rise. Candle ranges have expanded compared to the earlier phase, highlighting higher volatility but in favour of the bulls.

BUY TURMERIC APR ABV 16200.00 TGT 18800.00 SL BELOW 15200.00. NCDEX

Above views are of the author and not of the website kindly read disclaimer

.jpg)

More News

Silver Market to Remain Deficit for Fifth Consecutive Year in 2025 by Amit Gupta, Kedia Advi...