Copper seen firm on tight supply, China-US demand, stimulus hopes, easier policy - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is expected to remain volatile ahead of key policy decision from BOJ. Meanwhile, growing optimism over accommodative US monetary policy, persistent geopolitical risks and strong ETF inflows would limit its downside. Further, appointment of dovish US Federal Reserve Chair would also fuel the prospects of loose monetary policy from the Fed and support the bullions. For the day, spot gold is likely to move in the band of $4300 and $4380 per ounce. Only a move above it would turn bullish and move higher towards $4400 per ounce.

* MCX Gold Feb is hovering in a tight range of Rs.133,300 and Rs.135,600 since last 4-days. A move outside of the range would bring clarity in price trend. A move below Rs.133,000, would bring correction towards Rs.131,500. On the other hand, above Rs.135,600, it would rise towards Rs.137,000

* MCX Silver March hold strong support at Rs.201,000 level and move higher towards Rs.207,500. Above Rs.207,500 it would rise toward Rs.210,500.

Base Metal Outlook

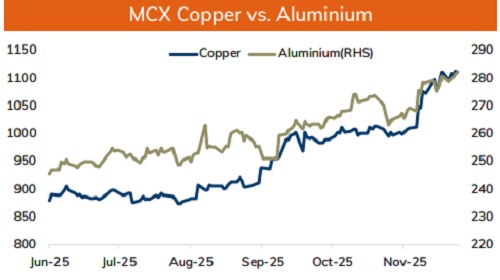

* Copper prices are expected to hold its ground and move higher on tight supplies and strong import demand from China and US. Additionally, growing bets of fresh round of stimulus from China to counter slowdown in the property sector would also help the metal to hold firm. Moreover, increasing prospects of lose monetary policy would again strengthen the bullish bias in the red metal. Meanwhile, investors will eye on key economic data from China to and home sales numbers from US to get further clarity.

* MCX Copper Dec is expected to hold support near Rs.1099 and move higher towards Rs.1120 level. Only break below Rs.1099 level it may fall towards Rs.1090- Rs.1085 level.

* MCX Aluminum Dec is expected to rise towards Rs.284 level as long as it stays above Rs.280 level. Only a move below Rs.280, it would slip towards Rs.275. MCX Zinc is hovering below 20-day EMA at Rs.306.50. As long as it stays under Rs.306.50 it would remain under pressure and slide towards Rs.299 mark.

Energy Outlook

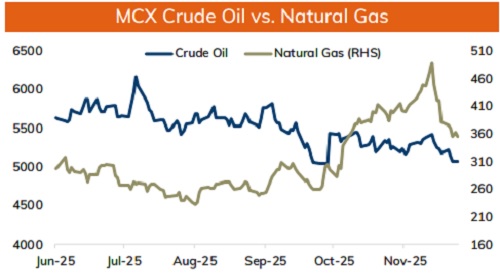

* NYMEX crude oil is trading lower as rising prospects of a RussiaUkraine peace deal outweighed concerns over supply disruption from Venezuela. Crude oil is expected to remain under pressure amid persistent oversupply concerns and weak global demand. Rising output from OPEC+ and higher production from US would restrict any major upside in oil prices. Meanwhile, escalating tension between US and Venezuela could hurt oil supplies from the region and limit downside in price.

* On the data front, a strong put base at $55 would act as strong support. On the upside a strong call base at $60 would act as major hurdle. MCX Crude oil Dec is likely to consolidate in the band of Rs.5000 and Rs.5180 level. Only move below Rs.5000 it would turn weak towards Rs.4900

* MCX Natural gas Dec is expected to move lower towards Rs.350 as long as it stays under Rs.370 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631