Insurance Sector Update: 2QFY26 Preview: All eyes on 2H growth by JM Financial Services Ltd

Private life insurers reported 8% YoY growth over Jul-Aug’25. We expect a slight pickup in September and a stronger 2H, given GST cuts and normalising base of both individual business and credit life. As far as margins are concerned, while falling deposit rates and rising G-sec yields bode well, GST cuts should keep margins in check. We expect YoY VNB growth of 14%/12%/11%/6%/2% for Axis Max Life/HDFC Life/SBI life/LIC/IPRU in 2Q. Amongst general insurers, we prefer ICICI Lombard – we expect it to report 8% YoY and flat QoQ results at INR 7.5bn, with a combined ratio of 104.9%. We expect Star Health to report a 150bps YoY improvement in claims ratio; however, with weak investment income, we expect PAT of INR 0.9bn. These are good outcomes in a quarter affected by monsoon and monsoon-borne diseases. We prefer life insurers, led by HDFC Life and IPRU, as we expect growth to return to double digits in 2HFY26, even with a quarter of sub-par margins.

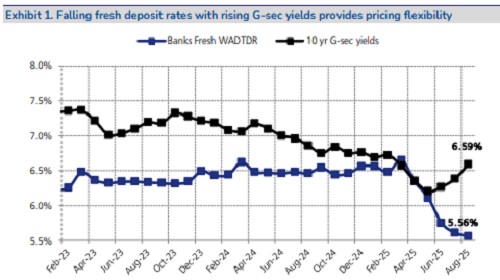

* Despite near-term profitability pressures, we expect life insurers to do well on growth front: Over July-August, private life insurers reported a YoY growth of 8% in individual APE, sluggish with expectation of GST cuts. Channel checks indicate strong growth post 22nd Sep;, however, full quarter growth in total APE is expected to remain range-bound at 15%/15%/13%/9% for Axis Max Life/HDFC Life/SBI life/LIC while IPRU is expected to report flat total APE. On the margins front, the quarter was fundamentally strong with deposit rates falling with a rise in Gsec yields. However, the impact of ITC (Input Tax Credit) following the GST cut is expected to weigh on margins. We expect margins to remain flat YoY for HDFC Life while we expect IPRU, LIC and SBI life to report ~1pp improvement YoY. Hence, we expect VNB growth of 14%/12%/11%/6%/2% for Axis Max Life/HDFC Life/SBI life/LIC/IPRU. We expect pressure on profitability in 3Q as well, before insurers can adjust their product portfolio to align with GST 2.0. At current valuations, we prefer HDFC Life for an expected 18% VNB CAGR over FY25- FY27e. We also like IPRU, which has shown strong margin performance despite weak growth. We expect the stock to do well hereon as it returns to growth from Dec’25 (with its base normalising).

* General insurers to see weak profitability growth: Over July-August, Star Health has grown in line with the industry at 2% YoY, while ICICI Lombard has seen 5% contraction in gross direct premiums. We expect NEP (Net Earned Premiums) to grow 12%/12%YoY for ICICIGI/Star Health. We expect loss ratio to improve by 40bps YoY for ICICIGI (to 71.0%) and 150bps for Star Health (to 71.3%). Without accounting for any surprise in investment income in 2Q26, we build in PAT of INR 7.5bn for ICICIGI (+8% YoY) and INR 0.9bn for Star Health (-23% YoY). As the base gets adjusted for 1/n with effect from 1st Oct’25, reported growth for the sector will improve. We like SAHIs for the strong growth in health insurance and the recent pass-through of ITC impact to intermediaries. However, we remain circumspect on claims performance in the near term for Star Health, while we expect a sharp rerating once the claims ratio improves with the price rise taken over the last year getting earned. With strong growth in fire and expectation of an improvement in motor growth, with GST 2.0 and potential hike in motor TP rates, we see a potential uptick in growth for ICICI Lombard, which is the key as the company is already delivering strong 19%+ RoEs.

* Valuations and view – continue to prefer life insurers over general insurance names: With higher growth and supporting macros (expanding spread between deposit rates and G-sec yields) and an uptick in growth with GST 2.0, supported by a normalising base in 2HFY26, we expect life insurers to do well, as concerns around profitability are incrementally addressed, with product innovations. We prefer HDFC Life and IPRU in the space. In general insurance, we expect strong headline growth to support stock prices post November. At CMP, we prefer ICICI Lombard in the space.

Life Insurance

In July-August, private life insurers reported a YoY growth of 8% in individual APE, sluggish with expectation of GST cuts. Channel checks indicate strong growth post 22nd Sep; however, full quarter growth in total APE is expected to remain range-bound at 15%/15%/13%/9% for Axis Max Life/HDFC Life/SBI life/LIC while IPRU is expected to report flattish total APE. On the margin front, the quarter was fundamentally strong with deposit rates falling with a rise in G-sec yields. However, the impact of ITC (Input Tax Credit) following the GST cut is expected to weigh on margins. We expect margins to remain flat YoY for HDFC Life while we expect IPRU, LIC and SBI life to report ~1pp improvement YoY. Hence, we expect VNB growth of 14%/12%/11%/6%/2% for Axis Max Life/HDFC Life/SBI life/LIC/IPRU. We expect pressure on profitability in 3Q as well, before insurers can adjust their product portfolio to align with GST 2.0. At current valuations, we prefer HDFC Life for an expected 18% VNB CAGR over FY25-FY27e. We also like IPRU, which has shown strong margin performance despite weak growth. We expect the stock to do well hereon as it returns to growth from Dec’25 (with its base normalising).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

More News

Automobiles & Components Sector Update : January volume print: A mixed bag by Kotak Institu...