Oil & Gas Sector Update : Crude Compass - Weekly Oil Market Dossier by Choice Institutional Equities

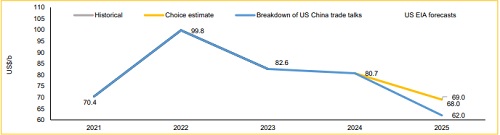

We maintain our estimate for Brent at US$69.0/b for the Calendar Year 2026 (as published on June 13, 2025) compared to YTD average of US$69.8/b.

In our view, following aspects will lead to volatility in oil price over the short-term:

* Geopolitical risk: According to market reports, Ukraine’s drone attacks on Russian oil infrastructure has so far reduced refining capacity by ~300kbd in August and September.

* Sanctions Watch: EU considering sanctions on Indian and Chinese companies facilitating Russian oil trade.

* OPEC+ Policy Signals: Initial discussions on production capacities ahead of in-person meetings in Vienna (Sept 18–19).

Moreover, surging very large crude carrier (VLCC) rates - US$87,000/day, highest in 2.5 years - indicate strong crude flows.

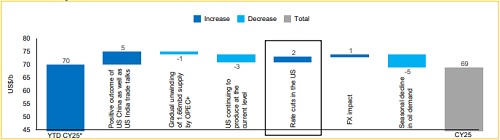

As highlighted in earlier publications including the report on Sept 11, 2025, the rate cuts by the US could drive the demand and lead to certain upside for oil price. We have baked in this increase in our CY25 estimate of US$69/b.

Meanwhile, actual increase in output by OPEC+ will drive the prices lower compared to mere announcement of increase in supply.

Given the ongoing developments -- particularly the possibility of US tariff impositions and subsequent renegotiations - we anticipate some market volatility. Nonetheless, Brent crude is likely to remain range-bound between US $60 and $75/b in absence any geopolitical escalation. Below US$60/b, marginal US supply becomes uneconomical, while above US$75/b, demand elasticity is expected to increasingly moderate prices in the current macroeconomic climate.

In this issue of Crude Compass we highlight how our estimate for Brent has fared against estimate by US EIA as well as YTD prices. Moreover, we provide our opinion on (a) ethanol blending in gasoline (b) the impact of adoption of alternate fuels in India.

Exhibit 1: Catalysts for Brent

Source: FactSet for Historical data, Choice Institutional Equities

*Note: YTD CY25 price as of Sept 17, 2025

Exhibit 2: Brent estimates

Source: FactSet for Historical data, Choice Institutional Equities

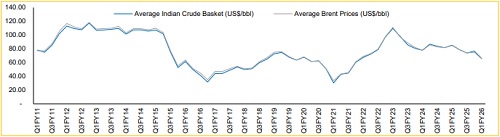

Exhibit 3: Average Indian Crude Basket (US$/bbl) against Average Brent Prices (US$/bbl)

Ethanol blending in gasoline and preparedness for EV penetration by OMCs

What has happened ?

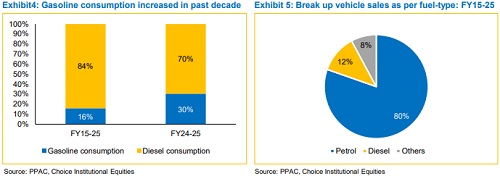

The blending of ethanol in gasoline has increased from 1.5% in 2014 to 20% in the present day. This drastic increase by the current administration is to: (a) reduce import dependency for crude oil (b) lower emissions. According to market reports, the calorific value of ethanol is significantly lower than that of gasoline which ultimately impacts fuel efficiency for vehicles sold prior to April 2023.

Our view:

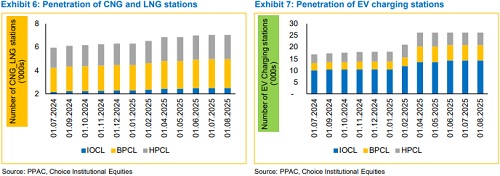

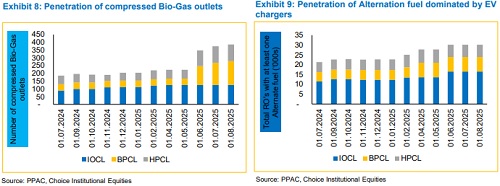

As gasoline to diesel consumption has increased significantly increase over the past decade, it still remains considerably lower as shown in Exhibit 4. However, the devil lies in the details wherein the sale of petrol vehicles over the past decade accounting for 80% of total. As a result, the number of individual consumers impacted on the back of above is higher. Moreover, we also highlight the impact of adoption of alternate fuels on OMCs. In our view, considering the number of Electric vehicles sold, the pace of infrastructure is lagging and disincentivize overall consumers. In our view, the impact of EV penetration on OMCs at the current rate remains minimal. However, PSUs are adopting to changing consumer trends as highlighted in Exhibit 6 to 9.

Exhibit4: Gasoline consumption increased in past decade

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131