Hold NOCIL (NOCIL IN) Ltd for the Target Rs.159 by PL Capital

Quick Pointers:

* Dumping pressure continues in the domestic market, leading to pricing pressure

* Rs2.5bn Dahej TDQ antioxidant expansion (~20% capacity addition) trial production targeted for H1CY26

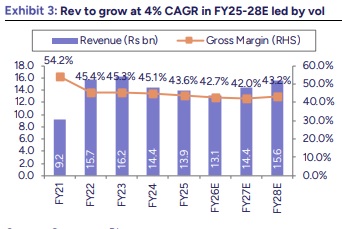

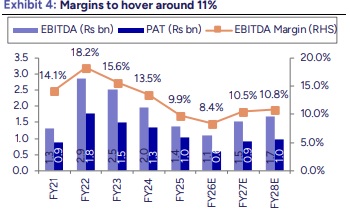

NOCIL reported revenue of Rs3.2bn (PLe: Rs3.2bn; Consensus: Rs3.2bn), declining 0.7% YoY and 1.5% QoQ. The topline was impacted by pricing pressure across the portfolio; however, volumes grew 2% QoQ and 11% YoY, led by domestic demand. Based on our estimates, average realization stood at Rs222/kg, reflecting a decline of 3% QoQ and 10% YoY. EBITDA/kg increased by 1% QoQ and 18% YoY, translating into an expansion of 150bps QoQ and 90bps YoY in EBITDA margin. Capacity utilization varied across product lines, with select rubber chemicals operating at elevated levels. To address rising demand for products such as TDQ antioxidants, where plants are already running at high utilization, the company is undertaking a Rs2.5bn capacity expansion. Trial production from these new capacities is expected to commence in H1CY26, while peak utilization across the expanded portfolio is likely to be achieved over the next 1.5–2 years. While near-term headwinds are expected to persist, a potential ADD on ~40% of the company’s product portfolio could provide meaningful earnings support. The stock is currently trading at ~26x FY28 EPS. We value the company at 28x Dec’27E EPS and maintain ‘HOLD’ rating with a target price of Rs159.

* Volumes grow by 11% YoY: Consolidated revenue stood at Rs3.2bn, down 0.7% YoY/ 1.5% QoQ (PLe: Rs3.2bn, Consensus: Rs3.2bn). 9MFY26 revenue was Rs9.7bn, down 7.6%. In Q3FY26, gross profit margin was 41.8% (vs. 44.5% in Q3FY25 and 41.2% in Q2FY26), down YoY 270bps due to increase in raw material cost. Volumes increased by 1.5% QoQ and 11% YoY.

* EBITDAM margin expands by 90bps YoY: EBITDA increased 11.6% YoY and 20.1% QoQ to Rs268mn (PLe: Rs221mn, Consensus: Rs257mn). EBITDAM stood at 8.5% (PLe: 7%) as against 7.6% in Q3FY25 and 7% in Q2FY26. 9MFY26 EBITDA declined by 22.5% YoY. Reported PAT was at Rs93mn, down by 28.3% YoY and 23.7% QoQ. PAT margin was at 3% in Q3FY26 vs. 4% in both Q3FY25 & Q2FY26, respectively. P&L includes a one-time exceptional charge of Rs54mn during the quarter on account of implementation of the new labor codes.

* Concall takeaways: (1) Volumes increased by 1.5% QoQ and 11% YoY in Q3FY26. (2) Domestic volumes witnessed high single-digit growth driven by improved demand due to GST 2.0. (3) Volumes in international markets were impacted due to the seasonal effect and US tariff issues. (4) FY26 full-year volume is expected to grow by 3-4%. (5) ADD: Outcomes expected in next 1.5-2 months (total 4 notifications against China, EU, US, Korea, Thailand). (6) Domestic YoY volume growth was in double digits; same momentum is expected in Q4. (7) FY27 volume growth is expected to be in double digits. (8) Working capital management, freight cost negotiation and some other factors led to reduction in other expenses. (9) Many products in the pipeline once launched are expected to lead to additional 10%-12% volume growth, mostly in FY28. (10) Dahej capex: Capex for TDQ antioxidant portfolio on track, trail production to start in H1CY26 .

Above views are of the author and not of the website kindly read disclaimer