Defence Sector Updat : Q1FY26 Quarterly Results Preview by Choice Broking Ltd

Structural upcycle intact - strong execution, policy momentum, and export tailwinds to drive resilient growth.

India’s defence sector continues to operate within a strong structural upcycle, propelled by increased capital allocation, accelerating indigenization, and growing global trust in India as a strategic defence partner. For Q1FY26, we expect companies across the value chain from DPSUs like HAL, BEL, and BDL to agile, private players to post healthy revenue growth, largely in the mid to high teens. Margins are expected to remain stable or expand slightly YoY, driven by operating leverage and a favorable product mix. And large order books (3x-6x book to bill for BEL, HAL, and BDL) continue to provide multi-year growth visibility.

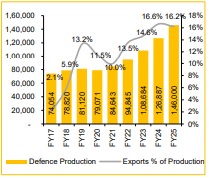

The sector’s outlook is further supported by the record FY26 capital outlay of INR 1.72 Trillion (up 9% YoY), with 75% earmarked for domestic procurement. The MoD is reportedly targeting acquisitions worth INR 2 Trillion, alongside recent emergency procurement approvals for high-priority systems such as loitering munitions, naval radars, and EW suites. These developments benefit both established and emerging players, including BEL, BDL, Astra Microwave, Apollo Micro Systems, and Data Patterns. On the global front, India’s defence exports surged to INR 21,083 crore in FY25 (a 32% YoY increase). Long-term contracts with global OEMs and JV’s such as HAL-Safran and BEL-Thales further reinforce India’s role in global supply chains.

Defence production vs Exports over FY17-25 (INR Cr)

Global OEM linkages are making Indian defence players integral to global value chains.

Indian defence companies are rapidly transitioning from domestic suppliers to strategic partners in the global aerospace and defence ecosystem. Export revenues have increased ten folds over the past decade, surpassing INR 21,000 crore in FY25, with a government target of INR 50,000 crore by 2029. This growth underscores the rising integration of Indian firms into global supply chains, led by collaborations with international OEMs.

Strategic joint ventures - such as HAL-Safran and BEL-Thales, are strengthening India’s defence technology capabilities, facilitating the development of advanced platforms and subsystems. These alliances not only enhance indigenous capabilities but also pave the way for longterm, non-cyclical export contracts, reinforcing India’s position as a key node in global defence value chains.

View: We remain structurally positive on India’s defence ecosystem, supported by strong government backing, robust execution capabilities, and long-term policy visibility. We expect Q1FY26 earnings to reflect this transformation, with companies across the value chain from platforms to electronics and components demonstrating resilience, execution strength, and healthy visibility. HAL and BEL remain our top picks, given their scale, execution track record, and strategic relevance in the evolving defence landscape. We view any short-term volatility as an opportunity to accumulate high-quality names with long-term structural upside.

Defence export from FY17-25 (INR Cr)

Risk associated to our view:

Risks to our view include geopolitical tensions, dependence on foreign technology, supply chain disruptions impacting execution timelines, fiscal constraints potentially affecting defence spending.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131