Defence & Aerospace Sector Update : Q2FY26 Quarterly Results Preview by Choice Broking Ltd

Sustained Momentum Ahead – Indigenisation, Faster Procurement and Export Tailwinds Anchor Defence Sector Growth

We believe the defence sector remains firm in a structural upcycle, supported by strong execution, favourable policy momentum and export tailwinds. The newly-introduced Defence Procurement Manual (DPM) 2025 prioritises faster revenue purchases and deeper indigenisation – a key catalyst for domestic suppliers, especially mid- and small-cap players with ready capacity. By streamlining procurement and shortening lead times for spares and maintenance, DPM 2025 opens avenues for private firms to replace imports in modular and electronic systems, supporting steady order inflows ahead.

At the large-cap level, order flows remain robust. The Cabinet’s approval of a INR 62,370 Cr contract for 97 LCA Mk-1A aircraft secures multiyear revenue visibility for HAL and its supply chain. Execution schedules and supplier margin will be the key determinants of how this order benefits industry players

Even though GE engine supplies are facing delays, the MoD’s decision to move ahead with the order reflects strong confidence in Indian manufacturing capabilities. We see this as a positive signal not just for HAL, but for the broader defence ecosystem. This reaffirms the longterm visibility of domestic defence programs and should lift sentiment across the sector.

Global OEM linkages are making Indian defence players integral to global value chains

Strategic joint ventures, such as HAL-Safran and BEL-Thales, are strengthening India’s defence technology capabilities, facilitating the development of advanced platforms and subsystems. These alliances not only enhance indigenous capabilities but also pave the way for long-term, non-cyclical export contracts.

View: We remain structurally positive on India’s defence ecosystem, policy in favour of indigenisation, coupled with a steady flow of orders, is reshaping the sector. We expect Q2FY26 earnings to reflect this transformation. Companies, from platform manufacturers to electronics and components suppliers are demonstrating resilience, execution strength and healthy visibility.

High-conviction investment ideas: We maintain a positive stance on BEL, BDL and Data Pattern, which are expected to deliver strong growth in Q2FY26.

Risk associated with our view:

Deliveries hinge on customer acceptance trials. PSUs with long payment terms can strain cash conversion. Pricing of rare metal, which is used in semiconductors, can slow down fulfilment of defence equipment.

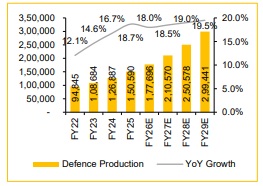

Defence Production to expand ~18% CAGR over FY22-29E (INR Cr)

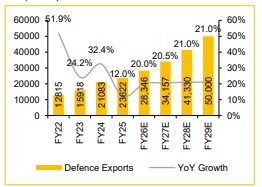

Defence export to expand 20.6% CAGR over FY25- 29E (INR Cr)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

Chemical Sector Update : Earnings visibility dims as EPS cuts continue by PL Capital