Consumer Discretionary Sector Report : Packed for the long haul

The Indian luggage industry is entering a sustained recovery cycle following demand disruption and margin pressure, driven by aggressive discounting and rising competition – Thus, we remain constructive on the space. With D2C players constrained by offline reach and high acquisition costs, established leaders – Safari and VIP Industries – are well-placed to benefit from domestic capacity expansion, improved product mix, and tighter cost controls. Functionality-led demand is fueling both affordable and premium segments. We initiate coverage on Safari Industries with a BUY (TP INR 3,111) as it is a key beneficiary of the structural upcycle, driven by a scale-up in domestic capacity and market-share gains, and on VIP Industries with a BUY (TP INR 430) as a turnaround opportunity, backed by brand reinvention with re-rating potential.

Tailwinds intact for the industry: We believe the Indian luggage sector is poised for a strong upcycle. Per VIP Presentation, the space is expected to compound at ~12% CAGR in CY23-28 to reach INR 360bn, driven by rising mobility, recovery in tourism, and education- and work-led migration. Also, branded penetration is expected to rise to ~60% by CY27 (from ~54% in CY24), supported by consumer preference for quality and durability. These structural tailwinds — alongside premiumization in hard luggage and share gains from unorganized players — should sustain healthy growth for established brands.

Consumer trends – Functionality-led demand reshaping behavior: Growth in value-led segment is outpacing the premium category as consumers prioritize functional, durable, design-led products over pure brand premium. Affordable and mid-priced brands are offering functional performance at competitive price points, strengthening presence. The rise of digital-first brands has accelerated design innovation and responsiveness. Their ability to iterate quickly and introduce feature-rich products have expanded consumer choice and reinforced the industry’s tilt toward functional utility over brand positioning. As this mid-premium gap is addressed, we expect steady premiumization, driven by scaled incumbents with brand strength and supply-chain edge.

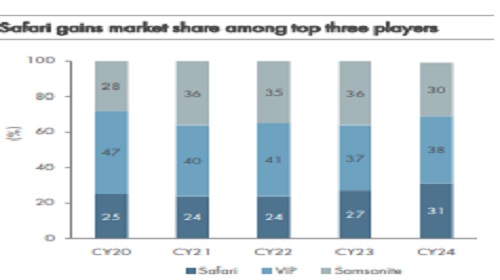

Steadily moving toward perfect competition: The Indian luggage market, historically concentrated among VIP, Samsonite, and Safari, is shifting from a three-player oligopoly to a highly competitive arena, marked by low entry barriers and rising fragmentation. Digitalnative brands, private labels, and D2C entrants have expanded aggressively, eroding the dominance of incumbents through sharper pricing, faster design cycles, and online-led reach. As manufacturing efficiencies erode the quality gap and brand loyalty in mass and mid-premium segments, rising price sensitivity is pushing the industry closer to a perfectcompetition environment, with limited pricing power for any single player.

Safari positioned for leadership; VIP in repair mode: We prefer Safari, led by clearer earnings visibility from stronger execution, rapid market-share gains in hard-luggage, backward-integrated capacity, and disciplined pricing that reinforce margin stability. For FY25-28E, we expect revenue, EBITDA and PAT CAGRs of 16.2%, 23.1% and 24.8%, respectively. VIP is in repair and stabilization mode. While Multiples-led ownership transition brings in sharper governance and renewed focus, the recovery hinges on consistent execution, margin restoration, and regaining market share. Amid constrained near-term upside, VIP’s turnaround trajectory offers a rerating potential, resulting in a favourable risk-reward. We initiate on VIP with a BUY and a TP of INR 430, on 26x FY28E EV/EBITDA. Key risks are intensifying competition, a sharp rise in input price and failure in identifying change in consumer demand.

Above views are of the author and not of the website kindly read disclaimer