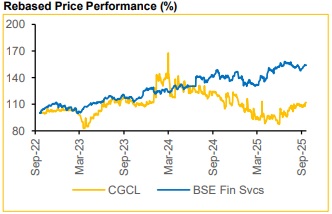

Buy Capri Global Capital Ltd for the Target Rs.230 by Choice Broking Ltd

Key Takeaways:

* AUM CAGR of 51% over FY22–FY25, the highest in the sector; AUM has grown by 58x over the last 12 years.

* CGCL is focussed on collateralised secured lending, primarily against gold and property

* Management expects to drive high growth fee income from Car Loan Distribution and Insurance Distribution segments

* Technology has been a core investment area with Data Science team at the forefront for collections and onboarding

* Scaled Gold Loans from start to 750 branches over an 18-month period, by March 2023

* Branch level productivity and profitability improvement helped PAT to rise, from INR 70 Mn in Q1FY25 to INR 1750 Mn by Q1FY26

Diversified portfolio with retail-centric approach

The company maintains a well-diversified portfolio both, product-wise (gold loans ~37%, other segments 18–20% each) and geographically (no region exceeds 22% of the book). Growth is propelled by a retailfocussed strategy and strong asset quality. Leveraging technologyenabled operations and robust underwriting, it sustains a high net interest margin of 8.9% while reducing the cost-to-income ratio, from 65% to 46%.

Low-cost front-end model driving high returns

Non-interest income accounts for 28% of CGCL’s Total Income, led by fees, insurance and channel origination. Leveraging partnerships with 12 banks, CGCL earns high fee income without risk sharing on its colending book. Its insurance distribution, via 18 partners, serves inhouse and third-party clients. A single front-end team handles both, lending and insurance, keeping incremental cost low

End-to-end digital origination and processing

CGCL leverages a 150-member in-house tech team, including over 25 data scientists, to drive fully digital loan origination, underwriting and collections. AI powers credit assessment, bureau checks and collateral evaluation, while micro-LAP verification uses geotagging and timestamps to prevent fraud. Risk-based pricing is applied on the basis of geography, business type and profile deviations, with real-time dashboards monitoring sanctions, collections and staff productivity.

Strategic vision and growth roadmap

CGCL aims to achieve INR 500 Bn AUM by FY28E, with 80% on its balance sheet and 20% through co-lending. The company is expanding across southern states and emerging in tier 3 and 4 cities, while investing in technology and digitisation to boost efficiency and scalability. It remains committed to industry-leading asset quality, profitability and customer experience.

Valuation – Maintain BUY with a TP of INR 230

We value CGCL using the Residual Income Approach. We calculated Cost of Equity to be at 11.3%, with ROEs projected to reach 18.3% by FY28E supported by Income Growth and softening cost. We retain our “BUY” rating on the stock with an upside of ~23%, implying P/ABV of 2.9x / 2.5x of FY27E/FY28E.

Key risks

Impact of changes in co-lending policy, possible downturn in economic conditions, leading to higher MSME delinquencies, slower-thanexpected loan growth and fluctuation in gold prices.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)